• Two hydrogen stations and 1 MW of electrolysis will equip Toulouse-Blagnac airport

• The solution developed will satisfy mobility and logistics needs, and will supply hydrogen to industrial sites interested in decarbonizing their processes

• This contract was announced in a press release on August 3, 2020 and prefigures the deployment of hydrogen in an airport environment

La Motte-Fanjas, March 4, 2021 – 7:45 am CET – McPhy (Euronext Paris: MCPHY – ISIN: FR0011742329), (the “Company”), a specialist in zero-carbon hydrogen production and distribution equipment, has been announced by HYPORT, a company 51% owned by ENGIE Solutions and 49% by the Occitanie Regional Energy and Climate Agency, as a key partner to design, manufacture and integrate two hydrogen stations and 1 MW of high-power electrolysis. This project was announced in a press release on August 3, 2020 (1).

Two hydrogen stations will be located in the immediate surroundings of the airport’s runways and roadways. They will enable all types of vehicles (buses, light commercial vehicles, captive fleets, large goods vehicles, etc.) to be refueled with hydrogen thanks to the “Dual Pressure” configuration (two distribution pressures: 350 and 700 bar) of one of them. The deployed electrolyzer, with a capacity of 400 kg per day, or the equivalent of 1 MW, will supply the stations as well as the nearby industrial sites. Deployment of the equipment is scheduled for the end of 2021.

This complete zero-carbon hydrogen production and distribution solution will power nearly 200 vehicles, including a fleet of 4 buses operated by Transdev to transport passengers within the airport.

Beyond its pioneering nature, the specificity of this project is based on the setting up of one station in a private restricted zone for airport services, while the second will be deployed in a public zone. McPhy’s selection for this project reflects the technical nature of its offer and its high level of service and support, supporting the deployment of hydrogen as a solution for the energy transition in the aeronautical sector.

Combining mobility, logistics and industrial uses, airports constitute real energy hubs, ideal for the development of hydrogen-based ecosystems. By producing and distributing zero-carbon hydrogen to power their services or taxi and bus fleets, airport areas are contributing to zero-emission strategies and the fight against climate change.

This project is counted in the 35 stations (2) and 44 MW (3) in reference for McPhy and demonstrates the maturity of its technology in the service of emblematic projects for the development of zero-carbon hydrogen, in France as well as internationally.

Next financial communication

2020 annual results release, on March 9, 2021, after close of market.

Footnotes

(1) https://mcphy.com/en/press-releases/new-contract-high-capacity-hrs-ely/

(2) References deployed, under installation or in development. Among them: 2 stations are included in the ZEV framework contract’s conditional part [contract signature: 18, June 2020].

(3) References deployed, under installation or in development. Among them: 4 MW are included in the ZEV framework contract’s conditional part [contract signature: 18, June 2020].

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy’s 2020 revenue increased by 20% and firm orders by 75 %: a very good business trend highlighted by emblematic projects

• Signing of major commercial contracts in France and Europe, with revenue of €13.7 million, representing an increase of +20%, and firm order intake (1) of €23.0 million in 2020, a growth of +75% compared with 2019

• New strategic partnerships with Chart Industries and Technip Energies, leading industrial players

• Cash position of €198 million at 31 December 2020, thanks to the €180 million capital increase in October 2020 for the industrialization of production methods, the development of new generations of machines and the acceleration of international commercial development

La Motte-Fanjas (France), January 26, 2021 – 5:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in zero-carbon hydrogen production and distribution equipment, today announces its annual revenue for the year to December 31, 2020.

Hydrogen gains momentum and I would like to thank the McPhy teams, as well as all our partners, for their confidence and support in the Company’s growth.

Laurent Carme, Chief Executive Officer of McPhy, states: “2020 was marked by the signing of several contracts reflecting the transition to industrial scale of McPhy, as well as of the entire zero-carbon hydrogen industry. McPhy has demonstrated the strong attractiveness and relevance of its offer and technology to serve emblematics large-scale projects at the heart of this hydrogen revolution.

The €180 million capital increase carried out in October 2020 gives us the means to achieve our ambitions to accelerate the development of our industrial capacities and the new generations of electrolyzers and hydrogen stations that meet the size, competitiveness and safety challenges demanded by the market. It also marks the strengthening of our partnership with our historical strategic shareholders, EDF Pulse Croissance Holding and the Ecotechnologies Fund represented by Bpifrance Investissement as part of the “Programme d’Investissements d’Avenir” (set up by the French State to finance innovative and promising investments on the territory), and new strategic investors such as Chart Industries and Technip Energies.

As a major technological and industrial partner in the hydrogen industry, McPhy is well positioned to take advantage of a very favorable business trend which should continue and expand in 2021. The strategic plan for hydrogen, presented by the European Commission on July 8, 2020 which aims to develop the demand and production capacities of green hydrogen in Europe with a target of 6 gigawatts (GW) in 2024, and 40 GW in 2030, specifically supports companies of the future like McPhy. France is also committed to this voluntarist policy, with the creation in January 2021 of the National Hydrogen Council. This institution, of which McPhy is a member, has the mission to ensure the deployment of the National Strategy for the development of decarbonated hydrogen (3).

Hydrogen gains momentum and I would like to thank the McPhy teams, as well as all our partners, for their confidence and support in the Company’s growth.”

Signature of major commercial contracts in France and Europe, with revenue of €13.7 million representing an increase of +20%, and firm orders of €23.0 million for 2020, representing an increase of +75% compared with 2019

McPhy’s 2020 sales increased by 20% to €13.7 million, compared with €11.4 million in 2019. It is made up of 60% by the supply of electrolyzers (of which 49% are large-capacity electrolyzers) and 40% by hydrogen stations.

Among the outstanding events of the year:

• McPhy was selected by Nouryon and Gasunie, two leading industrial groups, to equip “Djewels” project in the north of the Netherlands, one of the largest zero-carbon hydrogen production platform (20 MW) in Europe (4)

• McPhy, alongside with Atawey and TSM-HRS, has been selected by the project company Hympulsion to equip the largest zero-emission hydrogen mobility deployment project in France and one of the most ambitious in Europe: Zero Emission Valley (5)

• McPhy has secured firm orders:

- to equip the “mobility” part of a zero-emission hydrogen ecosystem in the Centre-Val de Loire region in France (6) ;

- with the German engineering and cleantech company Apex Energy for a 2 MW electrolysis platform (7) ;

- with Total to deploy a hydrogen station in Le Mans (8) ;

- with Hynamics to provide a complete zero-carbon hydrogen chain in Auxerre(9) ;

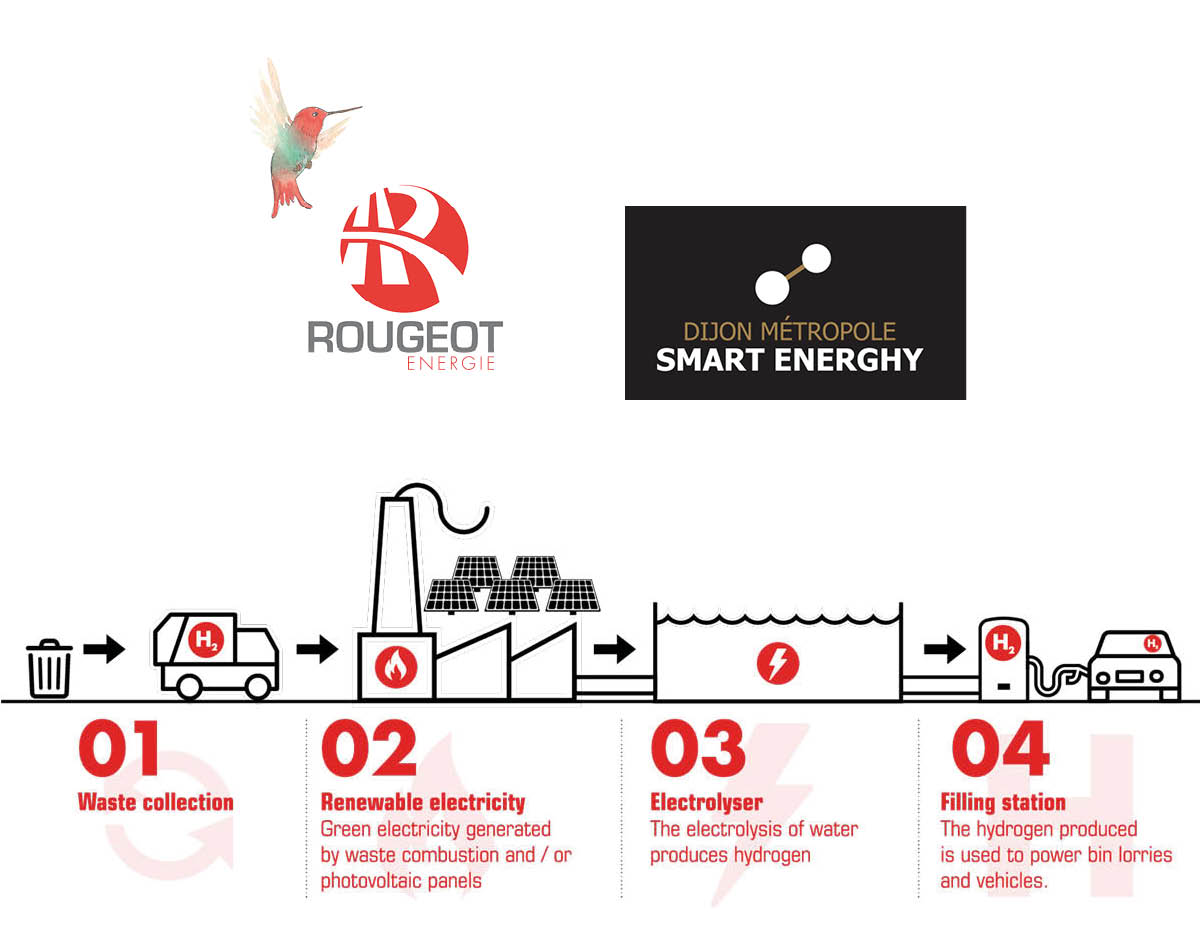

- with Rougeot Energie to design, build and integrate two hydrogen stations connected to a high-power electrolyzer in Dijon (10) ;

- to equip two hydrogen refueling stations and 1 MW of electrolysis (11).

The increase in the number of projects and the change in scale of the implemented technologies are contributing to the industrialization of the sector, reducing the associated costs and encouraging the development of competitive solutions with the highest standards of performance, quality and safety.

To date, the total number of contracts for which McPhy has been selected brings to 44 MW (12) and 35 stations (13) its total number of references.

Strategic partnerships with leading industrial groups

In a particularly favorable context for zero-carbon hydrogen, McPhy has strengthened its position as a major player in this industry by signing strategic partnerships with Chart Industries and Technip Energies, two leading industrial groups in their respective sectors:

- Chart Industries: world leader in equipment for liquefaction (LNG and liquid hydrogen) and cryogenics,

- Technip Energies: international engineering, procurement, construction and installation (“EPC”) group for the energy market, world leader in the installation of hydrogen production systems (SMR).

In addition to their participation in the capital increase initiated on October 13, 2020, these two strategic players bring in-depth expertise that complements McPhy’s technologies. Combined with EDF’s long-standing support, a genuine ecosystem of complementary know-how and geographies has thus been formed to enable the Company to respond to very large-scale projects in the fields of industry, mobility and energy, all over the world.

Cash position of €198 million at 31 December 2020, thanks to the €180 million capital increase in October 2020 for the industrialization of production methods and international ramp-up development

Following the success of the capital increase through a private placement last October, the Company has increased its shareholder’s equity capital and has a cash position of €198 million at 31 December 2020. As mentioned in the amendment to the 2019 universal registration document (14), approved by the Autorité des Marchés Financiers on October 14, 2020, the net proceeds of this capital increase will be used primarily to accelerate the deployment of the Group’s strategy and to finance:

- Acceleration of the change of scale of McPhy manufacturing capacity;

- Support for investment in research and innovation, with a focus on the development of very large-capacity electrolyzers to target large-scale projects (>100MW) and very large-capacity hydrogen refueling stations (>2 tons per day);

- Sales and marketing expenses, to accelerate the international commercial ramp-up;

- Acceleration of the recruitment policy.

Footnotes

(1) Firm orders: orders signed

(2) Unaudited figures as of the date of this document

(3) National strategy for the development of carbon-free hydrogen published by the French government on September 8 2020. A total of €7 billion will be invested between now and 2030, including €2 billion by 2022 as part of France Relance.

(4) https://mcphy.com/en/press-releases/industrial-hydrogen-a-20-mw-project-in-the-netherlands/

(5) https://mcphy.com/en/press-releases/zero-emission-valley-3/

(6) https://mcphy.com/en/press-releases/projects-in-zero-emission-mobility/

(7) https://mcphy.com/en/press-releases/2-mw-of-electrolysis-in-germany/

(8) https://mcphy.com/en/press-releases/inauguration-of-a-hydrogen-station-in-le-mans/

(9) https://mcphy.com/en/press-releases/zero-carbon-hydrogen/

(10) https://mcphy.com/en/press-releases/new-contrat-hydrogen-mobility/

(11) https://mcphy.com/en/press-releases/new-contract-high-capacity-hrs-ely/

(12) References deployed, under installation or in development. Among them: 4 MW are included in the ZEV framework contract’s conditional part [contract signature: 18, June 2020].

(13) References deployed, under installation or in development. Among them: 2 stations are included in the ZEV framework contract’s conditional part [contract signature: 18, June 2020].

(14) https://cellar-c2.services.clever-cloud.com/com-mcphy/uploads/2020/10/McPhy_Amendement-URD-2019.pdf

Next financial communication:

2020 annual results, on March 9, 2021 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

Press release

La Motte-Fanjas, on January 7th, 2021 – 05.45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329) specialized in zero-carbon hydrogen production and distribution equipment.

Due to the health crisis and to the administrative measures in force on the day of the convening of the shareholders’ general meeting prohibiting, pursuant to Decree n°2020-310 dated October 29th, 2020, gatherings of people, and in accordance with the provisions of Ordinance n°2020-321 dated March 25th, 2020, and in particular with article 4 of this Ordinance, whose duration was extended by Decree n°2020-925 dated July 29th, 2020, and as extended and amended by Ordinance n°2020-1497 dated December 2nd, 2020, the ordinary shareholders’ general meeting (the “General Meeting”) was held today, under the chairmanship of Mr. Pascal Mauberger, Chairman of the Board of Directors of McPhy, in camera, without the physical presence of the shareholders, at McPhy’s head office, 1115 Route de Saint-Thomas – 26190 La Motte-Fanjas upon convocation of the Board of Directors. Live and replay of the General Meeting was also provided by McPhy.

In this context, McPhy’s shareholders were able to cast their vote by correspondence or give a proxy using the voting form.

With a quorum of 42.10% (i.e. 11,728,438 shares out of the 27,855,480 voting shares), McPhy’s shareholders have very broadly adopted all of the resolutions recommended by the Board of Directors and in particular the appointments of two new board members, in the context of the share capital increase announced on October 14th, 2020:

- appointment of Chart Industries Inc., represented by Mrs. Jillian Evanko, as director of McPhy; and

- appointment of Technip Energies B.V., represented by Mr. Jean-Marc Aubry, as director of McPhy.

Resolution n°3 relating to the authorization and delegation to be given to the Board of Directors in order to enable it to intervene on the shares of McPhy (Determination of the terms in accordance with Article L. 225-209 of the French commercial code) was also approved by majority vote. In this regard, the Board of Directors of McPhy will meet within the next days to implement the share buyback program.

Next financial communication

2020 annual revenues release, on January 26, 2021, after markets close.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy joins the SBF 120 and CAC Mid 60 indices

La Motte-Fanjas, December 11, 2020 – 07.30 am CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329) specialized in zero-carbon hydrogen production and distribution equipment, today announces that, following the quarterly review of Euronext Paris indices, the Index Steering Committee has decided to include McPhy in the SBF 120 and CAC Mid 60 indices.

This decision will take effect from December 21, 2020 at markets opening.

The SBF 120 index is one of the flagship indices of the Paris Stock Exchange, consisting of the top 120 stocks listed on Euronext Paris in term of both liquidity and market capitalization.

The CAC Mid 60 index includes 60 companies of national and European importance. It represents the 60 largest French equities beyond the CAC 40 and the CAC Next 20. It includes the 60 most liquid stocks listed in Paris among the 200 first French capitalizations. This total of 120 companies compose the SBF 120.

This inclusion follows the one in the MSCI World Small Cap on November 30.

Next financial communication

2020 annual revenues release, on January 26, 2021, after markets close.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy will be included in the MSCI Smallcaps Index

La Motte-Fanjas, November 26, 2020 – 07.30 am CEST – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329) specialized in zero-carbon hydrogen production and distribution equipment, today announces that, following the quarterly review of the MSCI indices, the listed company will be included in the MSCI World Small Cap Index.

The MSCI World Small Cap Index includes the most liquid and highest-performing small caps of the 23 countries in the developed markets and represents approximately 14% of the free float-adjusted market capitalization in each country.

The company welcomes MSCI’s decision, which reflects the significant improvement in market capitalization and liquidity of McPhy’s stock in recent months.

This decision will take effect from November 30, 2020 at market opening.

Next financial communication

2020 annual revenues release, on January 26, 2021, after markets close.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy publishes an amendment to its 2019 Universal Registration Document and an admission to trading Prospectus for the new shares issued pursuant to its €180 Million private placement

La Motte-Fanjas, October 14th (20h CEST) – McPhy Energy (Euronext Paris: MCPHY – ISIN: FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment, announces today the availability of an amendment to its 2019 universal registration document and of an admission to trading prospectus for the new shares to be issued and admitted to trading on October 16, 2020 on Euronext Paris, following the €180 million private placement whose result was announced on October 14, 2020.

The prospectus is composed of:

- the 2019 universal registration document filed with the AMF on 22 April 2020 under number 20-0334;

- the amendment to the 2019 registration document filed with the AMF on 14 October 2020 under number D.20-0334-A01;

- a securities note (note d’opération) in English; and

- an English and French language summaries (résumé) of the prospectus (contained in the securities note).

The McPhy’s prospectus was approved by the AMF on October 14, 2020 under number 20-512 (the “Prospectus”).

The universal registration document and the Prospectus may be consulted on the AMF’s internet website (www.amf-france.org) as well as on McPhy’s website under (https://mcphy.com/fr/investisseurs/information-financiere/information-financieredocuments-a-telecharger/).

McPhy draws investors’ attention to the section “Risk factors” detailed in Chapter 3 of the Universal Registration Document and in chapter 2 of the securities note.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

McPhy is eligible PEA-PME

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Nicolas Fossiez | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

Disclaimer

This announcement and the information contained herein do not constitute either an offer to sell or purchase, or the solicitation of an offer to sell or purchase, securities of McPhy Energy (the “Company”).

No communication or information in respect of the offering by the Company of its shares may be distributed to the public in any jurisdiction where registration or approval is required. No steps have been taken or will be taken in any jurisdiction where such steps would be required. The offering or subscription of shares may be subject to specific legal or regulatory restrictions in certain jurisdictions. The Company takes no responsibility for any violation of any such restrictions by any person.

This announcement does not, and shall not, in any circumstances, constitute a public offering nor an invitation to the public in connection with any offer. The distribution of this document may be restricted by law in certain jurisdictions. Persons into whose possession this document comes are required to inform themselves about and to observe any such restrictions.

This announcement is an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 (the “Prospectus Regulation“), as implemented in each member State of the European Economic Area.

A prospectus for the admission to trading on Euronext Paris of the newly issued shares, comprised of a Universal Registration Document filed with the AMF on April 22, 2020 under number 20-0334, of a Securities Note and of summaries in French and English (included in the Securities Note) has been approved by the AMF under number 20-512. The prospectus is available on the Company’s website (https://mcphy.com/fr/investisseurs/information-financiere/information-financieredocuments-a-telecharger/) and on the AMF website (www.amf-france.org).

No action has been undertaken or will be undertaken to make available any shares of the Company to any retail investor in the European Economic Area. For the purposes of this press release:

• the expression “retail investor” means a person who is one (or more) of the following:

o a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II“); or

o a customer within the meaning of Directive 2016/97/EU, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II;

o or not a “qualified investor” as defined in the Prospectus Regulation; and

• the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or subscribe the shares.

The Company’s shares in connection with the capital increase are not being offered or sold, directly or indirectly, to the public in France to persons other than qualified investors. Any offer or transfer of shares of the Company or distribution of offer documents has only been and will only be made in France to qualified investors as defined by Article 2(e) of the Prospectus Regulation and in accordance with Articles L. 411-1 and L. 411-2 of the French Monetary and Financial Code.

This document may not be distributed, directly or indirectly, in or into the United States. This document does not constitute an offer of securities for sale nor the solicitation of an offer to purchase securities in the United States or any other jurisdiction where such offer may be restricted. Securities may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements thereof. The securities of the Company have not been and will not be registered under the Securities Act, and the Company does not intend to make a public offering of its securities in the United States. Copies of this document are not being, and should not be, distributed in or sent into the United States.

The distribution of this document (which term shall include any form of communication) is restricted pursuant to Section 21 (Restrictions on financial promotion) of Financial Services and Markets Act 2000 (“FMSA”). This document is only being distributed to and directed at persons who (i) are outside the United Kingdom, (ii) have professional experience in matters relating to investments and who fall within the definition of investment professionals in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the “Financial Promotion Order”), (iii) are persons falling within Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the Financial Promotion Order or (iv) are persons to whom this communication may otherwise lawfully be communicated (all such persons referred to in (i), (ii), (iii) and (iv) above together being referred to as “Relevant Persons”). This document must not be acted on or relied on in the United Kingdom by persons who are not Relevant Persons. Any investment or investment activity to which this document relates is available only to Relevant Persons, and will be engaged in only with such persons in the United Kingdom.

This document may not be distributed, directly or indirectly, in or into the United States, Canada, Australia, Japan South Africa or any other jurisdiction in which it would be unlawful to do so.

€ 180m Raised from Strategic Investors, Historical Shareholders and New Institutions to Fund Global Scale-Up of Zero-Carbon Hydrogen

La Motte-Fanjas, October 14 (07h30 CEST) – McPhy (Euronext Paris : MCPHY – ISIN : FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment, announces today the success of its capital increase without shareholders’ preferential subscription rights announced on October 13, 2020, by means of an Accelerated Bookbuild to the benefit of certain categories of beneficiaries, for a total amount of € 180m (the “Offering”).

The Offering was oversubscribed several times which enables the Company to upsize the amount of the Offering from an envisaged € 150 m to € 180 m. The subscription price of the new shares was set at € 23.50 per share, representing a discount of 8.56% based on the last closing price.

Chart International Holdings, Inc., part of Chart Industries, Inc. (NASDAQ: GTLS) (“Chart Industries”) and Technip Energies B.V. (“Technip Energies”) (the “Strategic Investors”) and historical strategic shareholders EDF Pulse Croissance Holding and Ecotechnologies Fund managed, by Bpifrance Investissement as part of the Programme d’Investissement d’Avenir, have participated in the Offering, significantly strengthening the Company’s shareholding structure.

Memorandum of Understandings (“MoU”) were concomitantly signed with the two Strategic Investors, setting collaboration frameworks to unlock new commercial opportunities globally in numerous hydrogen domains.

McPhy is, more than ever, well-positioned to scale up and prepared to meet the ever-growing needs of decarbonization in Industry, Mobility and Energy. We ambition to become a leading player in the zero-carbon hydrogen industry.

Laurent Carme, Chief Executive Officer of McPhy, comments: “We would like to thank all of the historical and new investors which have contributed to the outstanding success of this capital increase which is the most significant one to date for McPhy. With the great support provided by our new strategic partners Chart Industries and Technip Energies, our historical and strategic shareholders EDF Pulse Croissance Holding and Ecotechnologies Fund as well as all existing and new institutional investors, McPhy is now ideally positioned to scale-up its industrial capabilities, both from an operational and financial perspective. Our new strategic partnerships, with two world leading companies in their field, bring to McPhy important possibilities of complementarity, an increased international exposure and the ability to target large-scale projects. The Group is, more than ever, well-positioned to scale up and prepared to meet the ever-growing needs of decarbonization in Industry, Mobility and Energy. We ambition to become a leading player in the zero-carbon hydrogen industry.”

Jillian Evanko, Chief Executive Officer of Chart Industries, comments: “We are thrilled by the success of the offering and the reception McPhy has received from the institutional investor community. This is a landmark for hydrogen and underscores the potential we, McPhy, and Technip Energies, have to lead in the full hydrogen value chain globally. We look forward to begin working together on the many commercial opportunities ahead.”

Arnaud Pieton, President of Technip Energies, states: “The collaboration with McPhy is an important milestone for the future of the green hydrogen industry and demonstrates our ambition to accelerate the journey to a low-carbon society. We will work with McPhy to develop large scale and competitive carbon free hydrogen solutions from production to liquefaction, storage and distribution which we firmly believe is core to achieving net-zero targets. We are excited to be also joined by Chart Industries whose expertise lies in equipment development and is complementary to our process technology and project capabilities. We are proud to keep the same pioneering spirit and our commitment to technology and outstanding project execution to serve the energy transition.”

Advisors to the Company:

Bryan, Garnier & Co Limited is acting as Sole Global Coordinator and Sole Bookrunner in connection with the Offering. King & Spalding acted as Legal Advisor to the Company and to Bryan, Garnier & Co Limited as Transaction Counsel.

Highlights of the Offering:

- Gross proceeds from the Offering amount to € 180 m, an 20% upsize compared to the anticipated amount announced on October 13, 2020.

- 7,659,574 new shares were issued, representing a dilution of c. 38% based on the number of shares outstanding prior to the Offering.

- The subscription price of the new shares was set at € 23.50, representing a discount of 8.56% to the last closing price and of 11.78% to the volume weighted average price over the three preceding trading days (1).

- Strategic Investor Chart Industries subscribed to 1,276,595 shares for € 30 m, and now holds 4.59% of the capital post-Offering.

- Strategic Investor Technip Energies subscribed to 638,297 shares for € 15 m, and now holds 2.29% of the capital post-Offering.

- Historical long-term shareholder and strategic partner EDF Pulse Croissance Holding subscribed to 255,319 shares for € 6 m, and now holds 14.14% of the capital post-Offering.

- Historical and strategic long-term shareholder Ecotechnologies Fund managed by Bpifrance Investissement subscribed to 340,425 shares for € 8 m, and now holds 6.00% of the capital post-Offering.

- Institutional investors subscribed to 5,148,938 shares for an incremental € 121 m under the institutional placing.

Upon completion of the Offering, the share capital of the Company amounts to € 3,338,316, corresponding to 27,819,300 shares with a par value of € 0.12 each. By way of illustration, a shareholder holding 1% of the share capital prior to the Offering and which did not participate in the Offering will hold 0.72% after completion of the Offering.

Application will be made to list the new shares to be issued pursuant to the Offering on Euronext pursuant to a listing prospectus subject to a visa application with the French Autorité des marchés financiers (“AMF”) and comprising the 2019 Universal Registration Document (Document d’Enregistrement Universel 2019) registered with the AMF on April 22, 2020 under the number 20-0334, an amendment to the 2019 Universal Registration Document and a Securities Note (Note d’opération), including a summary of the prospectus. This prospectus (including the amendment to the 2019 Universal Registration Document) will be filed today with the AMF for approval in order to be made available to the public.

This prospectus will, upon its approval by the AMF, provide the most recent information available on the Company. These documents may be consulted, along with the Company’s other regulated information and all its press releases, on its website (www.mcphy.fr).

As the subscription commitments from the Strategic Investors were fulfilled, appointments at the Board of Directors of Jillian Evanko as representative of Chart Industries and of a representative of Technip Energies will be proposed for approval to the next shareholders’ general meeting to be held on or before January 31, 2021 at the latest. In the meantime, these representatives will be invited to the meetings of the Board of Directors.

Use of proceeds:

Net proceeds from the Offering will be used primarily to finance over the next 48 months:

- Acceleration of the change of scale of McPhy manufacturing capacities;

- Research & Innovation expenses, with a focus on the development of large capacity stacks to target large-scale projects (>100MW) and large-capacity hydrogen refueling stations (>2 tons per day);

- Sales and Marketing expenses, to accelerate the international commercial ramp-up;

- Acceleration of the recruitment policy;

- Working capital.

Admission to trading of the new shares:

The new shares carry current dividend rights, give right, from their issuance, to all distributions decided by the Company as of that date and will be admitted to trading on Euronext under the same ISIN code FR0011742329 – MCPHY on October 16, 2020.

Lock-up Undertakings:

McPhy has entered into a lock-up agreement ending 180 calendar days after the execution of the placement agreement entered into between the Company and the Sole Global Coordinator, today (the “Placement Agreement”).

The Strategic Investors, historical and strategic shareholders EDF Pulse Croissance Holding and Ecotechnologies Fund will each be subject to a lock-up on the new shares subscribed under the Offering for a period of 180 days from the settlement date of the new shares, subject to customary exceptions.

Risk factors:

The investors’ attention is drawn to the risk factors associated with the Company and its business presented in Section 3 of the 2019 Universal Registration Document filed with the AMF on April 22, 2020, which is available free of charge on the Company’s website (https://mcphy.com/fr/investisseurs/information-financiere/information-financieredocuments-a-telecharger/). The occurrence of all or part of these risks could have a negative impact on the Company’s business, financial position, results, development and outlook.

In this respect, it is specified that the amendment to the 2019 Universal Registration Document (Document d’Enregistrement Universel 2019) filed with the AMF following the completion of the Offer will include an update of the summary table of the Company’s main risk factors, the liquidity risk and the risk related to the uncertain nature of the additional financing, seeing their probability of occurrence and their degree of criticality reduced from “high” to “low”. In addition, the risk factor relating to the Covid-19 epidemic was updated. As of the date hereof, due to the current health situation, the Company notes certain delays in the expected order intake and certain delays in planned maintenance operations in high-risk countries. Short-term, these delays could have an impact on the Company’s business and/or generate a billing and/or collection delay.

Additionally, investors are invited to consider the following risks specific to this Offering:

(i) Dilution: shareholders will see their participation in the Company’s share capital diluted. In the event of a new call to the market, this would result in additional dilution for the shareholders;

(ii) Volatility and liquidity: the market price and liquidity of the Company’s shares may fluctuate significantly and fall below the subscription price of the new shares;

(iii) Impact on the stock market price: the sale by the main shareholders of the Company at the end of the lock-up period of a large number of Company’s shares may have a negative impact on the share price of the Company; and

(iv) Termination of the Placement Agreement: the Placement Agreement in respect of the Offering may be terminated by the Sole Global Coordinator at any time up to (and including) the settlement date. In the event that the Placement Agreement is terminated in accordance with its terms, all the orders of investors and the subscription agreements entered into under the Offering will be null and void.

This press release does not constitute an offer to sell or the solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction.

Footnotes

(1) In accordance with the 19th resolution of the shareholders general meeting held on May 20, 2020, providing a maximum discount of 20% to the volume weighted average price of the shares over the three preceding trading days.

Next financial communication

2020 annual revenues release, on January 26, 2021, after close of trading.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

McPhy is eligible PEA-PME

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Nicolas Fossiez | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

Disclaimer

This press release does not constitute an offer to sell or the solicitation of an offer to buy ordinary shares of the company, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. This announcement is an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017, as amended (the “Prospectus Regulation”).

In France, the Offering described above will take place solely as a placement to a category of qualified investors, in accordance with Article 1(4)(a) of the Prospectus Regulation (EU) 2017/1129 of the European Parliament and the Council and applicable regulations, including Article L. 225-138 of the French Code de commerce. In addition, in accordance with the authorization granted by the general meeting of the Company’s shareholders dated May 20, 2020, only the persons pertaining to the categories specified in the 19th resolution of such general meeting may subscribe to the Offering.

Application will be made to list the new shares to be issued pursuant to the Offering on Euronext pursuant to a listing prospectus subject to a visa application with the French Autorité des marchés financiers (“AMF”) and comprising the 2019 Universal Registration Statement (Document d’Enregistrement Universel 2019) registered with the AMF on April 22, 2020 under the number 20-0334, an amendment to the 2019 Universal Registration Document and a Securities Note (Note d’opération), including a summary of the prospectus.

This press release and the information it contains does not constitute an offer to sell, nor the solicitation of an offer to subscribe for or buy, new shares in the United States or any other jurisdiction where restrictions may apply including notably Canada, Australia or Japan.

The securities will be offered in the United States to persons reasonably believed to be qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The securities have not been and will not be registered under the Securities Act or any state or other jurisdiction’s securities laws. Accordingly, the securities may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under the Securities Act and any applicable state or other jurisdiction’s securities laws. Copies of this document are not being, and should not be, distributed in or sent into the United States.

This communication is being distributed only to, and is directed only at (a) persons outside the United Kingdom, (b) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), and (c) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as “relevant persons”). Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this communication or any of its contents.

Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the new shares has led to the conclusion in relation to the type of clients criteria only that: (i) the type of clients to whom the new shares are targeted is eligible counterparties, professional clients and retail clients, each as defined in Directive 2014/65/EU, as amended (“MiFID II”); and (ii) all channels for distribution of the new shares to eligible counterparties, professional clients and retail clients are appropriate. Any person subsequently offering, selling or recommending the new shares (a “distributor”) should take into consideration the manufacturers’ type of clients assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the new shares (by either adopting or refining the manufacturers’ type of clients assessment) and determining appropriate distribution channels. For the avoidance of doubt, even if the target market includes retail clients, the Sole Global Coordinator has decided it will only procure investors for the new shares who meet the criteria of eligible counterparties and professional clients.

This distribution of this press release may be subject to legal or regulatory restrictions in certain jurisdictions. Any person who comes into possession of this press release must inform him or herself of and comply with any such restrictions. This press release has not been independently verified and no representation or warranty, express or implied, is made or given by or on behalf of any of the Sole Global Coordinator or any of their parent or subsidiary undertakings, or the subsidiary undertakings of any such parent undertakings, or any of such person’s respective directors, officers, employees, agents, affiliates or advisers, as to, and no reliance should be placed on, the accuracy, completeness or fairness of the information or opinions contained in this press release and no responsibility or liability is assumed by any such persons for any such information or opinions or for any errors or omissions. All information presented or contained in this press release is subject to verification, correction, completion and change without notice.

This press release provides information on McPhy’s objectives, as well as forward-looking statements that do not constitute historical data and should not be considered as a guarantee that the facts stated will occur. This information is based on data, assumptions and estimates that McPhy considers reasonable. The Company operates in a competitive environment subject to rapid change and is therefore unable to anticipate all the risks, uncertainties or other factors likely to affect its business, their potential impact on its business or assess the extent to which the occurrence of a risk or combination of risks could cause actual results to differ materially from those identified in forward-looking information. This information is provided only as of the date of this press release. McPhy does not undertake to update any of this information or the forward-looking statements it is based on, unless a legal or regulatory obligation requires otherwise.

The Sole Global Coordinator is acting exclusively for the Company and no one else in connection with the Offering and will not regard any other person (whether or not a recipient of this press release) as its client in relation to the Offering and will not be responsible to anyone other than the Company for providing the protections afforded to its client nor for providing advice in relation to the proposed Offering. The Sole Global Coordinator is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

McPhy Announces New Strategic Partnerships with Chart Industries and Technip Energies and Simultaneous Launch of Anticipated € 150m Capital Increase to Fund Global Scale-Up of Zero-Carbon Hydrogen

Launch of an anticipated 150 million euros Capital Increase by way of an Accelerated Bookbuild comprising:

- Strategic Cornerstone investment from Chart Industries of € 30m

- Strategic Cornerstone investment from Technip Energies of € 15m

- Existing Shareholders Cornerstone investments totaling € 14m from EDF Pulse Croissance Holding and the Ecotechnologies Fund managed by Bpifrance Investissement

La Motte-Fanjas, October 13 (17h35 CEST) – McPhy (Euronext Paris : MCPHY – ISIN : FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment, announces today the launch of a capital increase without shareholders’ preferential subscription rights, by means of an Accelerated Bookbuild to the benefit of certain categories of beneficiaries, in accordance with Article L. 225-138 of the French Commercial Code for an anticipated aggregate amount of € 150m (the “Offering “).

The Offering comprises Cornerstone subscription commitments from Chart International Holdings, Inc., part of Chart Industries, Inc. (NASDAQ: GTLS) (“Chart Industries”) and Technip Energies B.V. (“Technip Energies” a segment of TechnipFMC plc) (the “Strategic Investors”) and from historical strategic shareholders EDF Pulse Croissance Holding and the Ecotechnologies Fund, managed by Bpifrance Investissement as part of the Programme d’Investissements d’Avenir.

The funds raised under the Offering will be used primarily to finance the acceleration of the change of scale of McPhy manufacturing capacities, to fund continued research and innovation with an emphasis on large-capacity stacks and large-capacity hydrogen refueling stations, as well as for working capital and operating expenses of the Company.

McPhy is also pleased to announce the concomitant signing of Memorandum of Understandings (“MoU”) with each of the two Strategic Investors.

McPhy is well positioned to play a leadership role in the global build-out of competitive zero-carbon hydrogen.

Laurent Carme, Chief Executive Officer of McPhy, comments: “We are thrilled to welcome Chart Industries and Technip Energies as Strategic Investors in McPhy. In addition to a significant capital injection, these new strategic partners bring deep expertise in their respective domains, and we anticipate new commercial opportunities in hydrogen across Europe and globally.

Moreover, the complementarity of their activities with our own will put McPhy in an optimal position to work on large projects in Industry, Mobility and Energy and to scale-up our industrial capabilities. We look forward to strengthening the Board of Directors with the presence of Jillian Evanko from Chart Industries and a representative of Technip Energies and to see our respective teams collaborating on a number of already identified projects.

I would like to thank EDF Pulse Croissance Holding and Ecotechnologies Fund for their continuous support to McPhy, both from an operational and financial perspective. We are also excited to welcome participation from existing investors and new institutions into the share capital of McPhy in conjunction with the announced capital raise.

More than six years after our IPO on Euronext in 2014, zero-carbon Hydrogen is now at major inflection point. With this fundraising, new Strategic Investors, the continued support of EDF Pulse Croissance and the Ecotechnologies Fund, as well as all our shareholders, McPhy is well positioned to play a leadership role in the global build-out of competitive zero-carbon hydrogen and on the decarbonization of industrial processes, of mobility sector, and in the energy storage.”

Highlights of the Transaction:

- McPhy intends to raise € 150m under the Offering, representing a dilution of c. approximatively 27.30% based on the number of shares outstanding prior to the Offering (1).

- Strategic Cornerstone Investment of € 30m from Chart Industries, a leading independent global manufacturer of liquefaction and cryogenic equipment servicing multiple applications in the energy and industrial gas markets, including hydrogen; which will hold c. 4.3% of the capital of McPhy post-Offering.

- Strategic Cornerstone Investment of € 15m from Technip Energies, a segment of TechnipFMC and a leading international contractor in engineering, procurement, construction and installation for the global energy industry, with proprietary hydrogen technology installed in 270 hydrogen production plants worldwide; which will hold c. 2.1% of the capital of McPhy post-Offering.

- Strategic Cornerstone Investments will all be made at the same price as that of institutional investors achieved in the Accelerated Bookbuild.

- Cornerstone Investment of € 6m from EDF Pulse Croissance Holding.

- Cornerstone Investment € 8m from the Ecotechnologies Fund, managed by Bpifrance Investissement as part of the Programme d’Investissements d’Avenir.

- Intended incremental institutional placing of c. approximatively € 90m by means of an Accelerated Bookbuilding.

- Net proceeds from the Offering will be used primarily to finance over the next 48 months:

Acceleration of the change of scale of McPhy manufacturing capacities;

Research & Innovation expenses, with a focus on the development of large capacity stacks to target large-scale projects (>100MW) and large-capacity hydrogen refueling stations (>2 tons per day);

Sales and Marketing expenses, to accelerate the international commercial ramp-up;

Acceleration of the recruitment policy;

Working capital. - Appointment of Jillian Evanko as McPhy Board representative of Chart Industries and a representative of Technip Energies at the Board of Directors of McPhy to be proposed at the next shareholders’ general meeting to be held on or before January 31, 2021.

Signing of a MoU with each Strategic Investor focusing on unlocking commercial opportunities across the Hydrogen value-chain globally, for a renewable period of five years.

Advisors to the Company:

Bryan, Garnier & Co Limited is acting as Sole Global Coordinator and Sole Bookrunner in connection with the Offering, as well as Sole Advisor in connection with the Cornerstone Investments from the Strategic Investors as well as EDF Pulse Croissance Holding and Ecotechnologies Fund (the “Sole Global Coordinator”). King & Spalding is acting as Legal Advisor to the Company and to Bryan, Garnier & Co Limited as Transaction Counsel.

Summary of the Offering:

The Offering comprises the Cornerstone Investment commitments and the Accelerated Bookbuild directed at institutional investors. Cornerstone commitments from Strategic Investors Chart Industries and Technip Energies and existing long-term shareholders EDF Pulse Croissance Holding and the Ecotechnologies Fund amount to € 59m. Via the Accelerated Bookbuild, McPhy intends to raise an estimated additional approximatively € 90m for the Company from French and international institutional investors. In total, McPhy anticipates raising approximately € 150m of gross proceeds from the Offering, which will in any case be limited to a maximum number of 11,000,000 shares, in accordance with the terms of the 19th resolution of the Company’s general meeting held on May 20, 2020.

The offering price per McPhy ordinary share for the Offering will be determined by the Board of Directors following the Accelerated Bookbuilding process commencing immediately and expected to end before markets open on the market of Euronext Paris (“Euronext”) on October 14, 2020. The offering price will not be less than 80% of the volume weighted average price of the share over the three preceding trading days (i.e. October 9 to October 13). All investors, including the Strategic Investors, EDF Pulse Croissance Holding and the Ecotechnologies Fund, and institutional investors will subscribe at the price determined in the Accelerated Bookbuild.

The Company will announce the results of the Offering and the final number of ordinary shares sold in the Offering as soon as feasible thereafter in a subsequent press release.

The Offering is made as part of a share capital increase without shareholders’ preferential subscription rights pursuant to Article L. 225-138 of the French Commercial Code, reserved to categories of beneficiaries satisfying determined characteristics under the 19th resolution of the Company shareholders’ general meeting held on May 20, 2020 following (i) in the EEA a book building process to qualified investors in accordance with Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 and belonging to the categories of persons satisfying determined characteristics and (ii) a private placement to investors belonging to the categories of persons satisfying determined characteristics outside the EEA in accordance with the rules specific to each country concerned, in particular outside the United States in reliance on Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”) and in the United States pursuant to an exemption from registration under the Securities Act.

The new shares will carry current dividend rights, will give right, from their issuance, to all distributions decided by the Company as of that date and will be admitted to trading on Euronext under the same ISIN code FR0011742329 – MCPHY on October 16, 2020.

Application will be made to list the new shares to be issued pursuant to the Offering on Euronext pursuant to a listing prospectus subject to a visa application with the French Autorité des marchés financiers (“AMF”) and comprising the 2019 Universal Registration Document (Document d’Enregistrement Universel 2019) registered with the AMF on April 22, 2020 under the number 20-0334, an amendment to the 2019 Universal Registration Document and a Securities Note (Note d’opération), including a summary of the prospectus.

This press release does not constitute an offer to sell or the solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction.

Proposal for the Appointment of Representatives from the Strategic Investors at the Board of Directors:

The subscription commitments from the Strategic Investors provide for the appointment at the Company’s Board of Directors of

- Jillian Evanko as representative of Chart Industries, and

- a representative of Technip Energies.

Such appointments will be proposed for approval to the next shareholders’ general meeting to be held on or before January 31, 2021 at the latest. EDF Pulse Croissance Holding and Bpifrance Investissement Ecotechnologies Fund, as well as the Strategic Investors, have committed to vote in favor of the related resolutions.

In the meantime, these representatives will be invited to the meetings of the Board of Directors.

Highlights of the Collaborations between McPhy and the Strategic Investors:

Chart Industries is a leading independent global manufacturer of highly engineered equipment servicing multiple applications in the Energy, Industrial Gas and Clean Energy Transition markets. With a 2019 total revenue of USD 1.3bn Chart’s unique product portfolio is used in every phase of the liquid gas supply chain, from liquefaction and purification to distribution, storage and end-use. Being at the forefront of the clean energy transition, Chart is a leading provider of technology, equipment and services related to liquefied hydrogen, natural gas, biogas and CO2 capture, amongst other applications. Chart is listed on NASDAQ under the symbol GTLS.

The MoU between McPhy and Chart Industries sets the pace of commercial collaboration to stimulate new hydrogen demand for the parties’ respective equipment and solutions globally, by identifying new customers and projects. Chart and McPhy will also work on studying options to scale up projects for production, storage, transport and fueling in all addressable markets. Chart Industries also intends to financially support the joint collaboration and partnership beyond the strategic investment contemplated today.

TechnipFMC is a global leader in the energy industry; delivering projects, products, technologies and services. With its proprietary technologies and production systems, integrated expertise, and comprehensive solutions, it is transforming its customers’ project economics. TechnipFMC is organized in three business segments — Subsea, Surface Technologies and Technip Energies. TechnipFMC is listed on NYSE and Euronext Paris under the symbol FTI.

Technip Energies offers extensive experience, technologies, know-how and unique project management capabilities for the global energy industry. Its expertise includes a full range of design and project development services, from feasibility studies to project delivery. With 60 years history executing some of the world’s largest and most complex projects, Technip Energies combines leading engineering and construction management capabilities with technological know-how to develop new solutions that will support the world’s energy transition. Technip Energies’ ambition is to accelerate the journey to a low-carbon society with a focus on core pillars of liquefied natural gas, sustainable chemistry, decarbonization and carbon-free energy solutions.

Technip Energies is already a market leader in hydrogen having provided proprietary technology for more than 270 hydrogen production plants worldwide.

The MoU between McPhy and Technip Energies establishes a collaboration framework for the manufacturing and commercialization of (i) hydrogen electrolysis production systems for heavy industry, renewable energy storage and large mobility projects and (ii) hydrogen distribution systems for large mobility projects. Through the MoU, McPhy and Technip Energies will to jointly address commercial opportunities, work on integrating their respective offerings and work jointly on research and development for hydrogen technology.

Lock-up Undertakings:

In connection with the Offering, the Company has entered into a lock-up agreement restricting the issuance of additional ordinary shares for a period ending 180 days after the execution of the placement agreement to be entered into between the Company and the Sole Global Coordinator on October 14, 2020 (the “Placement Agreement”).

The Strategic Investors, historical shareholders EDF Pulse Croissance Holding and Bpifrance Investissement’s Ecotechnologies Fund will each be subject to a lock-up on the new shares subscribed under the Offering for a period of 180 days from the settlement date of the new shares, subject to customary exceptions.

Underwriting of the Offering:

The Offering is not underwritten. The Offering is subject to the Placement Agreement, in accordance to which the Sole Global Coordinator undertook, with respect to the Company and in connection with the new shares, to use its best efforts for the new shares to be subscribed at the issue price on the settlement date of the Offering. The Placement Agreement does not constitute a firm undertaking (garantie de bonne fin) within the meaning of article L. 225-145 of the French Commercial Code.

The Placement Agreement may be terminated by the Sole Global Coordinator at any time up to (and including) the settlement date expected on October 16, 2020 under certain conditions. In the event that the Placement Agreement is terminated in accordance with its terms, all the orders of investors and the subscription agreements entered into under the Offering will be null and void.

Risk factors:

The investors’ attention is drawn to the risk factors associated with the Company and its business presented in Section 3 of the 2019 Universal Registration Document filed with the AMF on April 22, 2020, which is available free of charge on the Company’s website (https://mcphy.com/fr/investisseurs/information-financiere/information-financieredocuments-a-telecharger/ ). The occurrence of all or part of these risks could have a negative impact on the Company’s business, financial position, results, development and outlook.

In this respect, it is specified that the amendment to the 2019 Universal Registration Document (Document d’Enregistrement Universel 2019) filed with the AMF following the completion of the Offer will include an update of the summary table of the Company’s main risk factors, the liquidity risk and the risk related to the uncertain nature of the additional financing, seeing their probability of occurrence and their degree of criticality reduced from “high” to “low”. In addition, the risk factor relating to the Covid-19 epidemic was updated. As of the date hereof, due to the current health situation, the Company notes certain delays in the expected order intake and certain delays in planned maintenance operations in high-risk countries. These delays could have an impact on the Company’s business in the short-term and/or generate a short-term billing and/or collection delay.

Additionally, investors are invited to consider the following risks specific to this Offering

(i) Dilution: shareholders will see their participation in the Company’s share capital diluted. In the event of a new call to the market, this would result in additional dilution for the shareholders;

(ii) Volatility and liquidity: the market price and liquidity of the Company’s shares may fluctuate significantly and fall below the subscription price of the new shares;

(iii) Impact on the stock market price: the sale by the main shareholders of the Company at the end of the lock-up period of a large number of Company’s shares may have a negative impact on the share price of the Company; and

(iv) Termination of the Placement Agreement: the Placement Agreement in respect of the Offering may be terminated by the Sole Global Coordinator at any time up to (and including) the settlement date. In the event that the Placement Agreement is terminated in accordance with its terms, all the orders of investors and the subscription agreements entered into under the Offering will be null and void.

Footnotes

(1) Based on the closing price on October 12, 2020, of € 27.30

Next financial communication

2020 annual revenues release, on January 26, 2021, after close of market.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

McPhy is eligible PEA-PME

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Nicolas Fossiez | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

Disclaimer

This press release does not constitute an offer to sell or the solicitation of an offer to buy ordinary shares of the company, and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. This announcement is an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017, as amended (the “Prospectus Regulation”).

In France, the Offering described above will take place solely as a placement to a category of qualified investors, in accordance with Article 1(4)(a) of the Prospectus Regulation (EU) 2017/1129 of the European Parliament and the Council and applicable regulations, including Article L. 225-138 of the French Code de commerce. In addition, in accordance with the authorization granted by the general meeting of the Company’s shareholders dated May 20, 2020, only the persons pertaining to the categories specified in the 19th resolution of such general meeting may subscribe to the Offering.

Application will be made to list the new shares to be issued pursuant to the Offering on Euronext pursuant to a listing prospectus subject to a visa application with the French Autorité des marchés financiers (“AMF”) and comprising the 2019 Universal Registration Statement (Document d’Enregistrement Universel 2019) registered with the AMF on April 22, 2020 under the number 20-0334, an amendment to the 2019 Universal Registration Document and a Securities Note (Note d’opération), including a summary of the prospectus.

This press release and the information it contains does not constitute an offer to sell, nor the solicitation of an offer to subscribe for or buy, new shares in the United States or any other jurisdiction where restrictions may apply including notably Canada, Australia or Japan.

The securities will be offered in the United States to persons reasonably believed to be qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The securities have not been and will not be registered under the Securities Act or any state or other jurisdiction’s securities laws. Accordingly, the securities may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under the Securities Act and any applicable state or other jurisdiction’s securities laws. Copies of this document are not being, and should not be, distributed in or sent into the United States.

This communication is being distributed only to, and is directed only at (a) persons outside the United Kingdom, (b) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), and (c) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as “relevant persons”). Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this communication or any of its contents.

Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the new shares has led to the conclusion in relation to the type of clients criteria only that: (i) the type of clients to whom the new shares are targeted is eligible counterparties, professional clients and retail clients, each as defined in Directive 2014/65/EU, as amended (“MiFID II”); and (ii) all channels for distribution of the new shares to eligible counterparties, professional clients and retail clients are appropriate. Any person subsequently offering, selling or recommending the new shares (a “distributor”) should take into consideration the manufacturers’ type of clients assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the new shares (by either adopting or refining the manufacturers’ type of clients assessment) and determining appropriate distribution channels. For the avoidance of doubt, even if the target market includes retail clients, the Sole Global Coordinator has decided it will only procure investors for the new shares who meet the criteria of eligible counterparties and professional clients.

This distribution of this press release may be subject to legal or regulatory restrictions in certain jurisdictions. Any person who comes into possession of this press release must inform him or herself of and comply with any such restrictions. This press release has not been independently verified and no representation or warranty, express or implied, is made or given by or on behalf of any of the Sole Global Coordinator or any of their parent or subsidiary undertakings, or the subsidiary undertakings of any such parent undertakings, or any of such person’s respective directors, officers, employees, agents, affiliates or advisers, as to, and no reliance should be placed on, the accuracy, completeness or fairness of the information or opinions contained in this press release and no responsibility or liability is assumed by any such persons for any such information or opinions or for any errors or omissions. All information presented or contained in this press release is subject to verification, correction, completion and change without notice.

This press release provides information on McPhy’s objectives, as well as forward-looking statements that do not constitute historical data and should not be considered as a guarantee that the facts stated will occur. This information is based on data, assumptions and estimates that McPhy considers reasonable. The Company operates in a competitive environment subject to rapid change and is therefore unable to anticipate all the risks, uncertainties or other factors likely to affect its business, their potential impact on its business or assess the extent to which the occurrence of a risk or combination of risks could cause actual results to differ materially from those identified in forward-looking information. This information is provided only as of the date of this press release. McPhy does not undertake to update any of this information or the forward-looking statements it is based on, unless a legal or regulatory obligation requires otherwise.

The Sole Global Coordinator is acting exclusively for the Company and no one else in connection with the Offering and will not regard any other person (whether or not a recipient of this press release) as its client in relation to the Offering and will not be responsible to anyone other than the Company for providing the protections afforded to its client nor for providing advice in relation to the proposed Offering. The Sole Global Coordinator is authorized and regulated by the Financial Conduct Authority in the United Kingdom.

McPhy selected to equip two hydrogen refueling stations and 1 MW of electrolysis

• McPhy will design, manufacture and integrate a complete zero-carbon hydrogen production and distribution chain including two hydrogen refueling stations and 1 MW of electrolysis, for a turnover of nearly €4 million.