• McPhy has been chosen to equip, by the end of the year, the “mobility” component of a zero-carbon hydrogen ecosystem in the Centre-Val de Loire region in France, a large-scale project dedicated to the energy transition

• Conclusive first test phase on a station recently installed by McPhy in the Grand Ouest region in France enabling the regional hydrogen infrastructure to be densified

• These two projects confirm the relevance of the technological positioning of the McFilling “starter kit”, enabling regional hydrogen mobility to be initiated under the best performance and competitive cost conditions

• With 25 stations in reference (1), McPhy confirms its leadership in the field of zero-emission mobility

La Motte-Fanjas (France), April 9, 2020 – 8:45 am CEST – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces that it has been chosen to equip two projects in the field of zero-emission mobility.

These commercial successes confirm the relevance of our McFilling “starter kit” that is attracting clients thanks to its competitive price and its performances. This is an equipment that we have specifically scaled to rapidly and efficiently initiate a regional hydrogen project, before helping them deploy larger capacity stations (…)

A genuine driver of economic development and a source of sustainable growth, the objective of the first project located in the Centre Val de Loire region (2) is to convert surplus renewable electricity (wind and solar) into green gas. The resulting zero-carbon hydrogen will partly replace networks fossil gas but also meet clean mobility requirements thanks to the dedicated McFilling 20-350 by McPhy refueling station that will be installed there at the end of the year.

Located in the Grand Ouest region, the aim of the second project (3) is to refuel light vehicles (350 bar and partial refueling of 700 bar vehicles), but also heavy-duty vehicles for transporting people. The McPhy station was installed in mid-March 2020 and a first test phase has been successfully carried out.

Laurent Carme, Chief Executive Officer of McPhy, states: “We are delighted to have been chosen to be involved in two projects aiming to roll-out zero-emission mobility. These commercial successes confirm the relevance of our McFilling “starter kit” that is attracting clients thanks to its competitive price and its performances. This is an equipment that we have specifically scaled to rapidly and efficiently initiate a regional hydrogen project, before helping them deploy larger capacity stations that will meet future growth in their hydrogen needs. In the longer term, our ambition is to continue implementing genuine zero-carbon ecosystems, connected to renewable energy sources, producing zero-carbon hydrogen for value-creating mobility, industrial or energy applications.”

McPhy: a key partner in the roll-out of zero-emission mobility solutions

Making it possible to densify the hydrogen infrastructure, McPhy’s McFilling 20-350 station has numerous advantages. It is a robust technology that has demonstrated a very high availability rate. Its compact design and modularity allow it to evolve so as to support any other phase of a project.

The new generation of “starter kit”, selected for the two previously-mentioned projects, has an infrared connector that makes it possible to offer a refueling solution to vehicles with 350 bar pressure and a partial refueling solution (approximately 60%) to vehicles requiring a 700 bar refueling pressure.

McPhy’s “starter kit” model is a tried-and-tested technology that has already been chosen to equip numerous projects, notably for the cities of Paris and Rouen and as part of the “EAS-HyMob” project in Normandy.

Zero-emission hydrogen mobility at the heart of the energy transition

Hydrogen is a clean alternative fuel that significantly reduces the transport sector’s pollution. Indeed, a key characteristic of hydrogen vehicles is that they do not emit any pollutants, just water vapor.

With their high degree of autonomy and rapid refueling time, these vehicles are attracting a growing number of communities, constructors, fleet managers, fueling station operators and logistics platform operators. They notably appreciate the perfect combination of ease of use, continuity of service and contribution to the fight against air pollution.

In this context, with 25 stations in reference (4), McPhy is establishing itself as a key partner in the roll-out of zero-emission mobility solutions.

Footnotes

(1) Installed, being installed or under development references as of April 9, 2020

(2) The name of the client is confidential at this stage

(3) The name of the client is confidential at this stage

(4) Installed, being installed or under development references as of April 9, 2020

Upcoming events

• Annual General Meeting, on May 20, 2020

• Publication of 2020 first-half results, on July 28, 2020 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Théodora Xu | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

Information regarding the measures adopted by McPhy within the context of the Covid-19 pandemic

La Motte-Fanjas (France), March 30, 2020 – 5:45 pm CEST – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329) is a specialist in hydrogen production and distribution equipment.

Faced with the Covid-19 pandemic, McPhy has been determined to act as soon as possible by adopting the appropriate decisions to ensure that all its employees, clients and partners are protected. Remote working has thus been generalized for all staff whose activity allows this.

Following the various governmental measures announced since the Group published its 2019 annual results earlier this month, activity pertaining to the assembly of electrolyzers and the production of stacks at the San Miniato site in Tuscany, Italy, has been temporarily suspended since March 23 for a month. McPhy’s other production sites remain operational to date, with limited resources and strengthened safety conditions.

Furthermore, business continuity plans have been implemented across all of the Group’s sites, in strict compliance with the World Health Organization’s recommendations and the measures adopted by the authorities in the various countries in which the Group operates.

The Covid-19 pandemic will have an impact on the Group’s activity and its 2020 prospects, but it is difficult to quantify these impacts at the time of this press release, notably because of the uncertainty regarding the evolution and extent of the pandemic, as well as the duration of the lockdown measures imposed by governments.

The Group is currently assessing these impacts and regularly updating its estimates according to the evolution of the health situation, in order to best adapt its business continuity and staff protection measures.

Within this unprecedented context, cost reductions and the postponement of tax and social security payment deadlines have been implemented, it being specified that the Group is looking at a number of possibilities aimed at anticipating its additional future cash and working capital requirements related to the continuation of the health crisis over the coming months. As a reminder, the Group had a cash position of €13 million at the end of December 2019.

McPhy has confidence in its resilience and the solidity of its corporate project, driven by robust fundamentals and the hydrogen market’s positive outlook, enabling it to cope with the challenges of this pandemic.

Upcoming events

- Annual General Meeting, on May 20, 2020

- Publication of 2020 first-half results, on July 28, 2020 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Théodora Xu | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

Confirmation of McPhy’s industrial scaling up

• Strong revenue growth of 43% to €11.4 million in 2019, driven by excellent sales momentum over the year with orders booked in France and Europe

• Acceleration of the Group’s development, preparing the industrialization phase

• Strengthening of the financial structure with a cash position of €13 million at end-2019, notably following the success of the capital increase of almost €7 million carried out in November 2019

• Confirmation of medium-term growth prospects with McPhy’s industrial scaling up

La Motte-Fanjas (France), March 10, 2020 – 5:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces its annual results for the year to December 31, 2019, as approved by its Board of Directors.

We are more ready than ever to continue seizing new opportunities, and more particularly projects on an industrial scale.

Laurent Carme, Chief Executive Officer of McPhy, states: “Within a promising and high-potential market context, McPhy has been able to continue its ramping up and the consolidation of its technological leadership on its key markets.

Thanks to excellent commercial activity throughout the year, our revenue increased by 43% to €11.4 million in 2019. This buoyant growth, combined with good control over our operating costs, has enabled us to improve our results.

Following this rich and promising year, we are more ready than ever to continue seizing new opportunities, and more particularly projects on an industrial scale in order to sustainably support the necessary transition to a low-carbon, secure and competitive economy.”

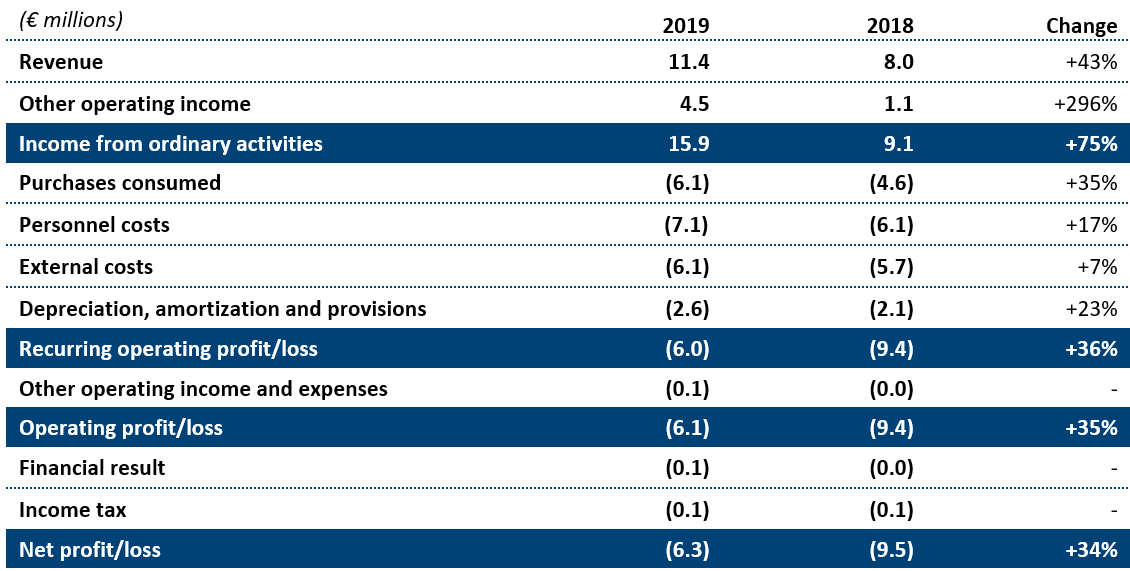

Simplified income statement

Strong revenue growth and improved result

In 2019, McPhy recorded a +43% increase in revenue to €11.4 million, versus €8 million in 2018. This growth was driven by the taking and completion of a number of orders for electrolyzers and hydrogen production and distribution stations in France and abroad.

The increase in other operating income was associated with the cancellation of the €3.5 million debt as part of the Pushy project (1) following the notification by BPI Financement in July 2019.

Purchases consumed and external costs evolved in line with activity, but only saw a limited increase given the cost reduction measures implemented to ensure a continual improvement in competitiveness. Moreover, the Company continued its research and innovation efforts.

To ensure the success of its industrialization phase, the Group strengthened its teams. The net recruitment of 12 people over the year thus took the total number of staff to 98 at December 31, 2019.

The increase in depreciation, amortization and provisions was primarily due to the mandatory effective date, on January 1, 2019, in accordance with the IFRS 16 (leasing contracts) for €0.6 million and the depreciation of 50% of the accrued receivables for the Hebei contract (project in China (2)) for €0.6 million.

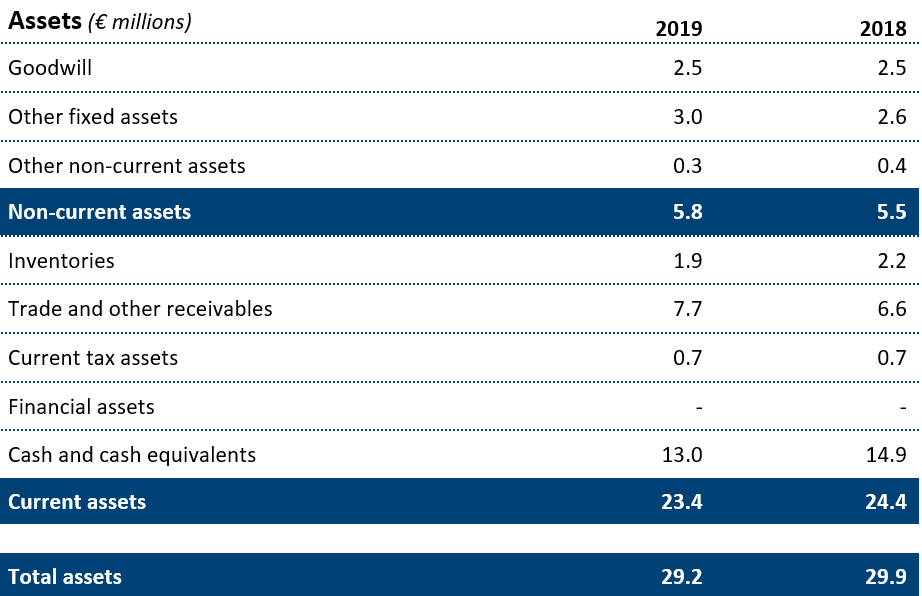

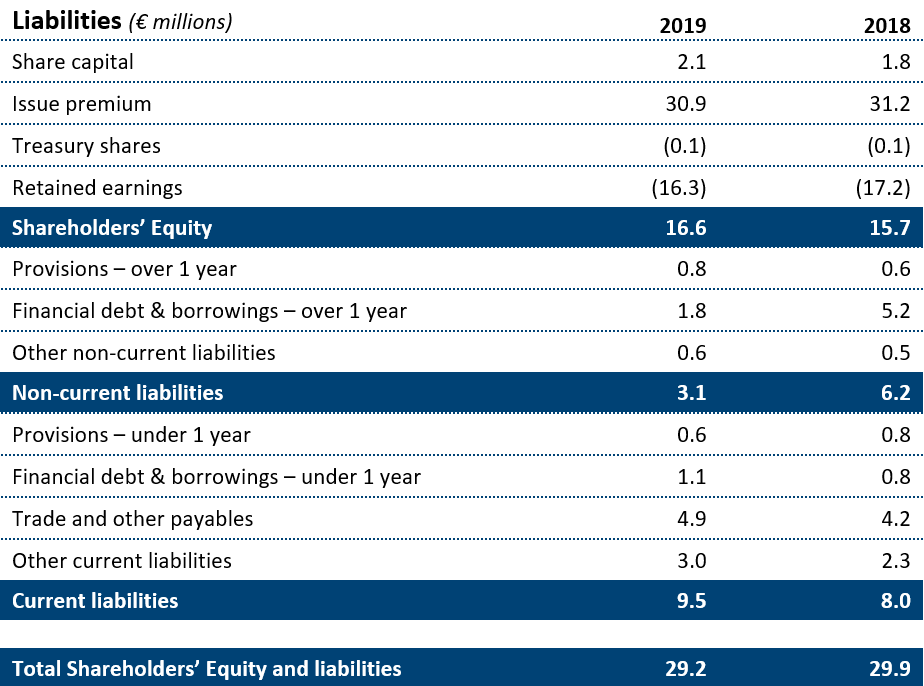

At December 31, 2019, McPhy had a cash position of €13 million, notably following the success of the capital increase by private placement of almost €7 million carried out last November.

As a reminder, McPhy’s Extraordinary Shareholders’ Meeting of January 16, 2020 approved the resolution concerning the issuance of 14,773,307 BSA stock warrants (“BSA”) enabling all shareholders (with the exception of Fonds Ecotechnologies and EDF Pulse Croissance Holding, who have agreed not to exercise any warrants allocated to them) to participate in the operation and benefit from the same subscription conditions. The stock warrants can be exercised from January 17, 2020 until May 18, 2020, i.e. two days before the Company’s Annual General Meeting called to approve its annual accounts for the year to December 31, 2019. The exercise of the stock warrants could strengthen the Company’s shareholders’ equity by a maximum of €2.8 million.

2019 highlights

• €13 million in orders booked in France and abroad, reflecting excellent sales momentum over the year

- Order for 7 stations taken from SIEGE 27 and SDEC Energie (3) for the roll-out of hydrogen mobility as part of the “EAS-HyMob” project in Normandy

- Order from Atawey (4) for a 40 kg per day 30-bar electrolyzer for a first hydrogen station in Chambéry, as part of the Auvergne-Rhône-Alpes region’s “Zero Emission Valley” project

- Order for 2 MW of high-pressure electrolysis in Germany for the Energy market for a Power-to-Power application

- Record order for McPhy’s PIEL range, with 11 electrolyzers for the Bangladesh Meteorological Department

- Order for a McFilling 200-350 station in Germany for refueling hydrogen buses, following a first order for a McLyzer 400-30 electrolyzer at the start of 2019

• April 2019: launch of “Augmented McFilling”, McPhy’s new smart hydrogen station architecture for heavy-duty vehicles

- “Augmented McFilling”, an innovative architecture for heavy-duty vehicles, able to address the massive hydrogen needs inherent to the necessary decarbonization of heavy-duty transport and long-distance vehicles (trains, trucks and buses), combining compression, storage, cooling and vehicle delivery functions

- Managed by McPhy’s smart supervision software, which makes the station dynamically reconfigurable for an infinite number of usage scenarios and real-time adaptation to clients’ requirements with no capacity limits

• June 2019: inauguration in the Hauts-de-France Region of the first refueling station for hydrogen buses in France

- In Houdain, northern France, a Artois-Gohelle Transport Authority (SMT-AG) project led by ENGIE GNvert, which has entrusted to McPhy the construction of a station with a daily capacity of 200 kg fueled by 0.5 MW of electrolysis

- A genuine innovation in France, this 100% hydrogen bus line and its refueling station are precursors of the “zero emission mobility” revolution that is becoming increasingly widespread in France, in Europe and on a global scale

- The entire clean hydrogen production, storage and distribution chain is equipped with McPhy technology

Confirmation of the transition to hydrogen production on an industrial scale

As previously announced (5), McPhy has been chosen by Nouryon and Gasunie, two leading industrial groups (6) to equip the first zero-carbon hydrogen production plant on a large scale in Europe, thus strengthening its leadership position on its market.

Designed, manufactured and integrated by McPhy, the 20 MW zero-carbon hydrogen production platform uses the Company’s innovative “Augmented McLyzer” electrolysis technology. Each year, 3,000 tons of clean hydrogen will thus be generated by electrolysis from green electricity. This hydrogen will be used to produce bio methanol used in industrial processes and will contribute to reducing CO2 emissions by up to 27,000 tons a year, the equivalent of the annual emissions of 4,000 French households.

McPhy will be involved in the pre-engineering phase from this year, and subsequently in the detailed engineering, production and commissioning of the electrolysis platform.

This major project marks a change in McPhy’s size, confirming its transition to an industrial scale with the aim of reducing zero-carbon hydrogen production costs and thus boosting the emergence of efficient and competitive hydrogen ecosystems with the highest quality and safety levels.

Update on the Covid-19 outbreak and its potential impact on the Group’s activity

Given the uncertainty regarding the future chain of events, it is currently difficult to quantify the impacts of the Covid-19 epidemic on the Group’s activity in 2020, notably in terms of revenue, results and delays for the completion of some projects. In accordance with domestic and international governmental recommendations, McPhy has implemented all necessary safety measures to limit its employees and partners’ travel and exposure to the virus.

In China, at this stage, McPhy’s exposure to the coronavirus epidemic is limited to a Power-to-Gas application project in Hebei province, a project that is currently affected by delays in its execution. As a reminder, in June 2017 McPhy delivered 4 MW hydrogen production equipment enabling the transformation into zero-carbon hydrogen and storage of excess energy produced by a 200 MW wind farm (7).

In Italy, McPhy has a subsidiary based in San Miniato (Tuscany) devoted to the assembly of electrolyzers and the production of stacks. The Group is closely monitoring the evolution of the outbreak and its expansion and has particularly noted the decree communicated by the Italian government extending the containment measures to the entire country.

In this context of uncertainty and volatility, McPhy is currently assessing the potential impact of the outbreak on its activity.

Upcoming events

• Annual General Meeting, on May 20, 2020

• Publication of 2020 first-half results, on July 28, 2020 (after market)

Footnotes

(1) This project was aiming at developing two innovative technological offers (OSSHY and LASHY) combining hydrogen production through the electrolysis of water and its storage in the form of hydrides

(2) 4 MW Power-to-Gas application project whose timeline is uncertain due to the Covid-19 outbreak.

(3) Project supported by EU funding via the European INEA (Innovation and Networks Executive Agency) as part of the CEF-T (Connecting Europe Facility – Transports) infrastructure program

(4) www.atawey.com

(5) See press release of January 22, 2020

(6) Nouryon, global leader in specialty chemicals, and Gasunie, gas infrastructure company

(7) See press release of June 29, 2017

(8) Audit procedures have been carried out and the audit certification report is currently being prepared

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Théodora Xu | Emmanuel Huynh

T. +33 (0)1 44 71 20 42

mcphy@newcap.eu

McPhy: strong revenue growth of +43% to €11.4 million in 2019

• Growth driven by excellent sales momentum over the year, with orders booked in France and Europe

• Capital increase of almost €7 million in November 2019 enabling the Company to roll-out its international activities and pursue its development strategy

• Confirmation of medium-term growth prospects with McPhy’s industrial scaling up

La Motte-Fanjas (France), January 28, 2020 – 5:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces its annual revenue for the year to December 31, 2019.

Laurent Carme, Chief Executive Officer of McPhy, states: “We ended 2019 on a very positive trend thanks to excellent sales activity throughout the year, initiated in the first half and confirmed during the second half which generated revenue growth of 58% compared with the same period in 2018. The taking and completion of orders in 2019 illustrate the relevance of our positioning on the industry, mobility and energy markets, as well as the technological maturity of our hydrogen production and distribution equipment.

The capital increase we carried out in November 2019 has given us the means to seize new opportunities within the context of an acceleration in the hydrogen market, and we would like to thank again all our investors for their trust.

The recognition of our know-how and our technology by major industrial groups and the zero-carbon hydrogen market’s positive outlook strengthen our confidence in our medium-term growth prospects. The signing, in January 2020, of an engineering contract to equip Europe’s largest zero-carbon hydrogen site (20 MW) substantiates this first step in McPhy’s industrial scaling up.”

McPhy records strong growth in 2019

As announced, McPhy recorded a +43% increase in revenue in 2019 to €11.4 million, versus €8 million in 2018. This growth was driven by the taking and completion of a number of orders for electrolyzers and hydrogen production and distribution stations in France and abroad.

In 2019, McPhy continued its ramp-up and the consolidation of its technological lead on its key markets.

The Company also strengthened its shareholders’ equity and, at December 31, 2019, had a cash position of €13 million, notably as a result of the success of the capital increase by private placement of almost €7 million carried out last November. This operation enables the Company to accelerate its development strategy and the roll-out of its international activities.

McPhy’s Extraordinary General Meeting of January 16, 2020 approved the resolution pertaining to the issuance of 14,773,307 stock warrants (“BSA”), thus enabling all shareholders (apart from Fonds Ecotechnologies and EDF Pulse Croissance Holding, who have agreed not to exercise any stock warrants allocated to them) to participate in the operation and benefit from the same subscription conditions. The stock warrants can be exercised from January 17, 2020 until May 18, 2020, i.e. two days before the Company’s Annual General Meeting called to approve its annual accounts for the year to December 31, 2019. The exercise of the stock warrants could strengthen the Company’s shareholders’ equity by a maximum of €2.8 million.

Bolstered by its commercial successes, a strengthened financial structure and its positioning as a major technological and industrial partner on a high-potential market, McPhy is reaffirming its confidence in its medium-term growth prospects.

Confirmation of the transition to hydrogen production on an industrial scale

According to the Hydrogen Council’s “Path to Hydrogen Competitiveness: A Cost Perspective” report, the scaling up of the zero-carbon hydrogen production and distribution markets and the industrialization of equipment manufacturing should lead to a reduction of up to 50% in costs by 2030.

Perfectly in line with the global acceleration of the sector, this cost-reduction trajectory will help strengthen the attractiveness and competitiveness of zero-carbon hydrogen.

Within this buoyant and high-potential context, McPhy has further strengthened its leadership position after it was chosen by two globally-renowned industrial groups to equip the first zero-carbon hydrogen production plant on a large scale in Europe.

Designed, manufactured and integrated by McPhy, the 20 MW zero-carbon hydrogen production platform uses the Company’s innovative “Augmented McLyzer” electrolysis technology. Each year, 3,000 tons of clean hydrogen will thus be generated by electrolysis from green electricity and utilized to produce bio methanol used in industrial processes, thus helping reduce CO2 emissions by up to 27,000 tons a year, the equivalent of the annual emissions of 4,000 French households.

This major project marks a change in McPhy’s size, confirming its transition to an industrial scale with the aim of cutting zero-carbon hydrogen production costs and thus promoting the emergence of efficient and competitive hydrogen ecosystems with the highest quality and safety levels.

Upcoming financial communication

2019 annual results, on March 10, 2020 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

McPhy to equip the largest zero-carbon hydrogen site in Europe

• The first zero-carbon hydrogen plant on this scale to be implemented in Europe, with a production capacity of 3,000 tons per year (20 MW)

• A project initiated by Nouryon and Gasunie, two leading industrial groups, to be installed in Delfzijl, the Netherlands

• Reducing CO2 emissions by up to 27,000 tons per year, pointing towards the decarbonization of the industry sector

La Motte Fanjas (France), January 22, 2020 – 08:00 am CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces it has been selected to equip the largest electrolysis plant for zero-carbon hydrogen production, the first of its kind and on this scale in Europe.

Now is the time to scale-up and industrialize clean hydrogen production technologies to lower their costs and boost the rise of a clean, secure and cost-competitive hydrogen ecosystem.

Laurent Carme, Chief Executive Officer of McPhy, states: “We are proud of the trust we received from Nouryon and Gasunie, two major industrial groups. The size and scope of this unique project, as well as its deep integration into our customers’ processes, represent a major step change for McPhy and more globally for the hydrogen market. Now is the time to scale-up and industrialize clean hydrogen production technologies to lower their costs and boost the rise of a clean, secure and cost-competitive hydrogen ecosystem.”

With the technology from McPhy we are one step closer to competitive large-scale production of green hydrogen.

Marcel Galjee, Energy Director at Nouryon Industrial Chemicals, adds: “Green hydrogen is a cornerstone of building a sustainable, circular economy. Nouryon is already a leader in electrolysis in Europe and with the technology from McPhy we are one step closer to competitive large-scale production of green hydrogen for a more sustainable future.”

The first large-scale zero-carbon hydrogen project to be implemented in Europe

The 20 MW hydrogen production platform will be designed, manufactured and integrated by McPhy with its innovative electrolysis technology “Augmented McLyzer” and will convert green electricity by electrolysis into 3,000 tons of clean hydrogen per year.

This will be used to produce bio methanol and will contribute to reducing CO2 emissions by up to 27,000 tons per year.

This project, initiated by Nouryon, a leading specialty chemical company, and Gasunie, a gas infrastructure company, is a front-runner among hydrogen initiatives with the objective of reducing carbon emissions.

The project’s value chain breaks down as follows:

- Conversion of electricity from renewable sources into zero-carbon hydrogen (by the 20 MW electrolysis platform developed by McPhy);

- Transport of hydrogen from the point of production to the point of consumption;

- Production of clean methanol.

The proposed clean hydrogen project will be funded by an €11m EU grant from the Fuel Cells and Hydrogen Joint Undertaking (FCH-JU) as well as an additional €5m in subsidies from Waddenfonds, a fund that invests in projects in the Netherlands.

McPhy, a technological breakthrough allowing hydrogen to transition to an industrial scale

This reflects our constant innovation policy as well as our expertise in large-scale platforms electrolysis.

Following a technological review conducted by Nouryon, the innovative electrolysis technology “Augmented McLyzer” by McPhy has been selected to be the cornerstone of this key project.

“This reflects our constant innovation policy as well as our expertise in large-scale platforms electrolysis. Our electrolysis platform will produce zero-carbon hydrogen with best-in class performances. This project confirms the relevance of our technological positioning and our transition to an industrial scale, in order to better meet the future needs of the industry as well as the mobility and energy sectors”, concludes Laurent Carme.

The “Augmented McLyzer” technology consists of a unique combination of McPhy 30-bar high-pressure alkaline electrolysis and a package of advanced electrodes, specifically designed for large-scale platforms (multi-MW).

It is currently the most mature and robust technology available on the market, recognized among the market leaders and one of the most promising in terms of future development.

McPhy will be involved in the pre-engineering phase and subsequently in the detailed engineering, production and commissioning of the electrolysis platform.

Upcoming financial communication

2019 annual revenues: Tuesday January 28, 2020, after market.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

About Nouryon

We are a global specialty chemicals leader. Markets worldwide rely on our essential chemistry in the manufacture of everyday products such as paper, plastics, building materials, food, pharmaceuticals, and personal care items. Building on our nearly 400-year history, the dedication of our 10,000 employees, and our shared commitment to business growth, strong financial performance, safety, sustainability, and innovation, we have established a world-class business and built strong partnerships with our customers. We operate in over 80 countries around the world and our portfolio of industry-leading brands includes Eka, Dissolvine, Trigonox, and Berol.

About Gasunie

Gasunie is a European gas infrastructure company. Gasunie’s network is one of the largest high-pressure pipeline networks in Europe, comprising over 15,000 kilometres of pipeline in the Netherlands and northern Germany. Gasunie wants to help accelerate the transition to a CO2-neutral energy supply and believes that gas-related innovations, for instance in the form of renewable gases such as hydrogen and green gas, can make an important contribution. Both existing and new gas infrastructure play a key role here.

About the Fuel Cells and Hydrogen Joint Undertaking (FCH-JU)

The Fuel Cells and Hydrogen Joint Undertaking (FCH JU) is a unique partnership between the European Commission and the industry to fund and support the development of hydrogen technologies including research, technological development and demonstration (RTD) activities in fuel cell and hydrogen energy technologies in Europe. Its aim is to accelerate the market introduction of these technologies, realizing their potential as an instrument in achieving a carbon-clean energy system.

The three members of the FCH JU are the European Commission, fuel cell and hydrogen industries represented by Hydrogen Europe and the research community represented by Hydrogen Europe Research.

All resolutions recommended by the Board of Directors were approved

La Motte Fanjas, January 16, 2020 – 5:45 pm CET – McPhy (Euronext Paris Compartiment C: MCPHY, FR0011742329) is a specialist in hydrogen production and distribution equipment. The Extraordinary General Shareholders Meeting of McPhy was held today at the head office of the Company, 1115, Route de Saint-Thomas – 26190 La Motte Fanjas (Drôme), France.

Shareholders present or represented totaling 7,545,461 (43.47%) voting rights, have adopted with a large majority all the resolutions recommended by the Board of Directors including the issuance of 14,773,307 stock warrants (“BSA”) announced in the Press release dated November 6, 2019.

It should be noted that the issuance and the allocation of the stock warrants is part of the capital increase through the issuance of new ordinary shares without preferential subscription rights in favour of qualified investors carried out by the Company on November 6, 2019.

In this context, a Board of Directors of the Company was held today in order to implement the resolution relating to the issuance of these stock warrants and to proceed with their allocation to the Company’s shareholders who have benefited from this right.

On December 20, 2019, the Autorité des Marchés Financiers (the “AMF”) approved the prospectus no.19-582 filed on the occasion of the admission to the regulated market of Euronext in Paris of the new shares resulting from the exercise of the stock warrants (Press release dated December 23, 2019).

Upcoming financial communication

2019 annual revenues: Tuesday January 28, 2020, after market

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

McPhy announces its 2020 financial calendar

La Motte Fanjas, November 25, 2019 – 5:45 pm CET – McPhy (Euronext Paris Compartiment C: MCPHY, FR0011742329), a specialist in equipment for the production and distribution of hydrogen, announces its 2020 financial calendar.

| Events | Dates (*) |

|---|---|

| 2019 Full-Year Sales | January 28, 2020 |

| 2019 Full-Year Results | March 10, 2020 |

| Annual General Meeting | May 20, 2020 |

| 2020 First-Half Results | July 28, 2020 |

| 2020 Full-Year Sales | January 26, 2021 |

| 2020 Full-Year Results | March 9, 2021 |

(*): Press releases are published after market closes. Subject to modification.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

McPhy completes a capital increase by private placement of almost €7 million

La Motte Fanjas (France), November 7, 2019 – 7:30 am CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces the success of a capital increase via the issuance of new ordinary shares without preferential subscription rights (the “Issuance”).

The Company has placed 2,552,544 new shares with a par value of €0.12 per share, at a unit price of €2.70, including the issuance premium, for a total amount of approximately €6.9 million (1), representing 17.3% of the Company’s share capital.

The strengthening of shareholders’ equity will enable us to accelerate the roll-out of our international activities and pursue our development strategy.

Laurent Carme, Chief Executive Officer of McPhy, states: “We sincerely thank all the investors who made this transaction a success in a difficult market environment, and in particular the Ecotechnologies Fund, managed by Bpifrance Investissement, and EDF Pulse Croissance Holding, who have renewed their confidence in the Company. The strengthening of shareholders’ equity will enable us to accelerate the roll-out of our international activities and pursue our development strategy.”

The funds raised will enable McPhy to strengthen its shareholders’ equity and finance its working capital requirements, in a context of revenue growth:

- One-third of the funds will allow the Company to participate in covering its working capital requirements for the next 18 months;

- One-third of the funds will be dedicated to address the acceleration of the activity, the market and ongoing projects, in particular with regard to very high capacity hydrogen production platforms; and

- One-third of the funds will be dedicated to financing R&D and product development so that the Company can begin the industrialization phase of its equipment.

McPhy is already anticipating revenue growth of around 40% in 2019 compared with 2018, i.e. 2019 revenue of at least €11 million. Moreover, as indicated in its Universal Registration Document, McPhy has received a conditional order intent and has entered into exclusive negotiations for the construction and commissioning of a 20 MW electrolyser platform to be installed in Europe; the first phase being the engineering contract.

As part of this capital increase without preferential subscription rights, the subscription price of McPhy shares was set at €2.70 per share (including the issuance premium), corresponding to a discount of 20.1% compared to the closing price on November 4, 2019 and 19.1% compared to the volume-weighted average price of McPhy share on the Euronext Paris regulated market during the last three trading days before the fixing of the issuance price.

This operation is completed pursuant to article L. 225-138 of the French Commercial Code and by virtue of the fifteenth resolution of the Combined Shareholders’ Meeting of May 23, 2019.

Following the transaction, McPhy will issue 2,552,544 new ordinary shares, bringing the total number of McPhy shares to 17,325,851 shares.

The issued shares represent 17.3% of the capital and voting rights before the Issuance, and 14.7% after the Issuance. As an indication, the participation of a shareholder holding 1% of McPhy’s share capital prior to the issuance and who did not participate in the issuance will be reduced to 0.85% at the end of the operation.

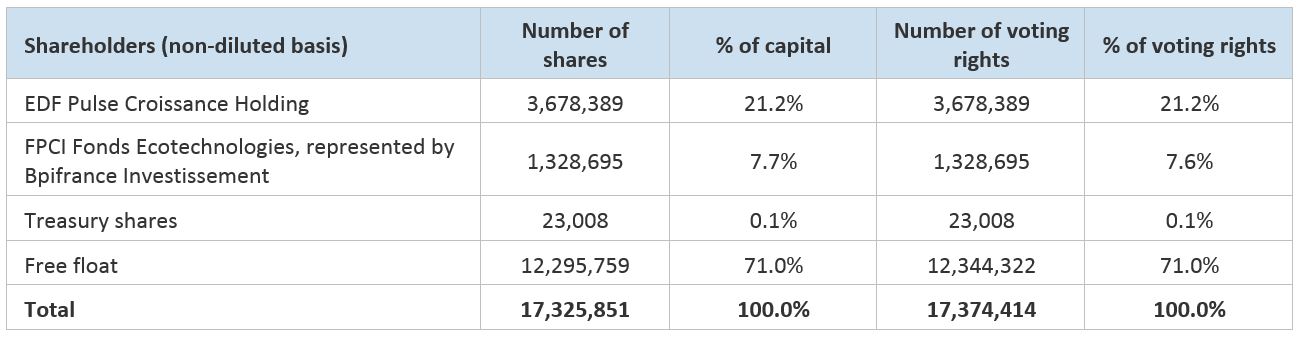

Following this capital increase and on the basis of the information available to the Company, the breakdown of the capital is as follows:

The new shares will be assimilated to the existing shares and will carry current dividend rights. They will be listed on the Euronext market on the same listing line as the existing shares under ISIN code FR0011742329. The settlement-delivery of the new shares issued as part of the private placement and their admission to trading on the Euronext regulated market in Paris are scheduled for November 12, 2019. The new shares will have full dividend rights.

As part of the transaction, the Ecotechnologies Fund, managed by Bpifrance Investissement as part of the Future Investment Program (“Programme d’Investissements d’Avenir”) and EDF Pulse Croissance Holding have signed a lock-up commitment covering all the Company shares they hold for a duration of 90 days from the settlement-delivery date, while the Company has signed an abstention commitment for a duration of 180 days from the settlement-delivery date.

The private placement was led by Gilbert Dupont, sole Lead Manager and bookrunner. The transaction was the subject of a placement agreement entered into on November 7, 2019 between the Lead Manager and bookrunner and the Company, covering all the offered shares. This agreement does not constitute a performance guarantee within the meaning of Article L. 225-145 of the French Commercial Code. In the event of termination of the placement agreement, subscription orders and the offer would be retroactively cancelled.

Free warrant allocation

In order to allow all shareholders to participate in the planned issuance and benefit from the same subscription conditions, the Company wants to propose the free allocation of stock warrants (“BSA (2)”) to all existing shareholders prior to the Issuance; in this respect, a right to BSA will be granted by Euroclear to all shareholders of the Company as of November 6, 2019. These warrants would allow their holders to subscribe to new shares at the Issuance price, i.e. €2.70 per new share. One BSA would be allocated for each existing share held, and 10 BSA would allow their holder to subscribe to one new ordinary share.

Within this framework, the Ecotechnologies Fund and EDF Pulse Croissance Holding have pledged to vote in favor of the Shareholders’ Meeting resolution regarding the issuance of these BSA, which will be voted on at an Extraordinary Shareholders’ Meeting which will be held on January 16, 2020. In the event of a favorable vote, a Board of Directors of the Company will meet on the same day at the end of the Extraordinary General Meeting in order to allocate the warrants to the Company’s shareholders who have benefited from this right. The Ecotechnologies Fund and EDF Pulse Croissance Holding have also agreed not to exercise any BSA they may be allocated.

The full exercise of the warrants would result in the creation of 1,048,013 new shares and would result in a 6% dilution of the share capital and voting rights after the Issuance (3).

The BSA would not be admitted to the negotiations.

Universal Registration Document and forward-looking statements

Detailed information on the Company, in particular with regard to its business, results, outlook and corresponding risk factors, can be found in the Company’s Universal Registration Document filed with the Autorité des Marchés Financiers (4) (the “AMF“) on November 4, 2019 under number D.19-0926 which may be consulted, as well as other regulated information relating to the Company (including its 2018 audited financial statements and its half-yearly financial statements as at 30 June 2019), all of the Company’s press releases and the investor presentation, on the Company’s website (www.mcphy.com).

This press release contains forward-looking statements. These statements are not guarantees of McPhy’s future performance. This forward-looking information relates to McPhy’s future prospects, evolution and business strategy and is based on the analysis of future earnings forecasts and market data estimates. By its nature, forward-looking information involves risks and uncertainties because it relates to events and depends on circumstances that may or may not occur in the future. McPhy draws investors’ attention to the fact that forward-looking statements are not guarantees of its future performance and that its actual financial position, results and cash flows and developments in the industry in which McPhy operates may differ materially from those proposed or suggested by the forward-looking statements contained in this document. In addition, even if McPhy’s financial position, results, cash flows and developments in the industry in which McPhy operates were consistent with the forward-looking information contained in this document, such results or developments may not be a reliable indication of McPhy’s future results or developments.

The Company draws investors’ attention to the risk factors presented in Chapter 4 of the Universal Registration Document; the occurrence of all or some of these risks is likely to have an adverse effect on the Company’s business, financial position, results or ability to achieve its objectives.

The Company also draws investors’ attention to the main specific risks related to the securities to be issued:

(i) Dilution: Shareholders who do not subscribe to this capital increase will have their shareholding in the Company’s share capital diluted. In the event of a new market call, this would result in additional dilution for shareholders;

(ii) Liquidity: The market price and liquidity of the Company’s shares could fluctuate significantly;

(iii) Risks related to the transaction: The Company may require additional financing. It is specified that the Group’s consolidated net working capital is sufficient to meet its current obligations over the next 12 months.

The information contained in the Universal Registration Document and this press release makes it possible to maintain, in all material respects and as necessary, equal access to information relating to the Company for the various shareholders and investors.

Projected timeline

November 7, 2019

Allocation of the right to the allocation of warrants by Euroclear

November 12, 2019

Reception of the subscription price – Issuance of the New Shares and settlement-delivery of the New Shares

Board of Directors of the Company acknowledging the completion of the Issuance

Euronext notice relating to the admission of the New Shares to trading on Euronext Paris

No later than December 12, 2019

Convocation of the Extraordinary General Meeting

January 16, 2020

Extraordinary General Meeting concerning in particular the allocation of warrants

Meeting of the Board of Directors

Trading suspension

The Company recalls that it has requested Euronext Paris to suspend the trading of its shares as from Tuesday, November 5 before market opening. McPhy share trading will resume on November 7, 2019 at market opening.

(1) Before exercise of stock warrants (“BSA”, Bons de souscription d’actions in French), please read the dedicated paragraph.

(2) Bons de souscription d’actions in French.

(3) Subject to the allocation of the warrants.

(4) French stock market authority.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr

Launch of a private placement of approximately €8 million and warrant allocation

La Motte Fanjas (France), November 5, 2019 – 6:45 pm CET –McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces the launch of a capital increase via the issuance of new ordinary shares without preferential subscription rights for certain categories of investors, of approximately €8 million, as well as a warrant allocation project for all shareholders to enable them to subsequently participate in the capital increase operation. A request to list the new shares will be made to Euronext.

Context of the Issuance

The funds will be raised from French and international qualified investors, with the notable exception of those in the United States, Canada, Australia and Japan, in accordance with articles L.225-136 of the French Commercial Code and L.411-2 II of the French Monetary and Financial Code (the “Issuance”).

The funds raised will enable McPhy to strengthen its shareholders’ equity and finance its working capital requirements, in a context of revenue growth:

- One-third of the funds will allow the Company to participate in covering its working capital requirements for the next 18 months;

- One-third of the funds will be dedicated to address the acceleration of the activity, the market and ongoing projects, in particular with regard to large hydrogen platforms; and

- One-third of the funds will be dedicated to financing R&D and product development so that the Company can begin the industrialization phase of its products.

As part of the Issuance, the Ecotechnologies fund managed by Bpifrance Investissement as part of the Future Investment Program (“Programme d’Investissements d’Avenir”) and EDF Pulse Croissance, key shareholders of the Company holding respectively 7.7% and 21.2% of the capital, have pledged to subscribe to the Issuance based on their percentage holdings, i.e. a total of 28.9% of the Issuance.

McPhy is already anticipating revenue growth of around 40% in 2019 compared with 2018, i.e. 2019 revenue of at least €11 million. Moreover, as indicated in its Universal Registration Document, McPhy has received a conditional order intent and has entered into exclusive negotiations for the construction and commissioning of a 20 MW Electrolyser platform to be installed in Europe; the first phase being the engineering contract.

Terms of the Issuance

By virtue of the fifteenth resolution of the Combined Shareholders’ Meeting of May 23, 2019, the Issuance will be undertaken without preferential subscription rights. Pursuant to article L. 225-138 of the French Commercial Code, it will be reserved for one or several categories of investors as defined in the fifteenth resolution approved by the Shareholders’ Meeting of May 23, 2019, i.e.: French or foreign investment companies and investment funds (including, but not limited to, all FCPI, FCPR and FIP funds) that invest in the biotechnology and clean-technology sectors; French or foreign investment companies and investment funds (including, but not limited to, all FCPI, FCPR and FIP funds) that commonly invest in small or mid caps; French or foreign groups or companies with which the Company intends to sign or has already signed partnerships with the aim of (i) developing hydrogen production, storage and distribution solutions and (ii) industrializing such solutions; industrial companies whose activity is similar or complementary to the Company’s activity; physical persons who wish to invest in a company in order to benefit from a reduction in income tax; and companies that commonly invest in small or mid caps in order to allow their shareholders or associates to benefit from a reduction in income tax.

In accordance with the fifteenth resolution of the Combined Shareholders’ Meeting of May 23, 2019, the number of new shares to be issued as part of the Issuance may not exceed 22.7% of the current capital. The issuance price of the new shares will be at least equal to the Company’s average weighted share price on the Euronext regulated market in Paris during the three trading sessions prior to the setting of the issuance price, possibly reduced by a maximum discount of 20%.

The Issuance will be conducted via an accelerated book building process following which the number and price of the newly-issued shares will be determined. The accelerated book building will start immediately and is expected to end before the markets open tomorrow, subject to any early closing or extension. The Company will announce the result of the Issuance in a subsequent press release as soon as possible after the end of the book building process. The settlement-delivery of the new shares issued as part of the Issuance and their admission to trading on the Euronext regulated market in Paris are scheduled for no later than November 12, 2019. The new shares will have full dividend rights and be traded on the Euronext Paris under ISIN code FR0011742329.

Should the Issuance represent more than 20% of the current share capital, the offering for Company shares as part of the Issuance would give rise to a Prospectus requiring a visa from the AMF (French stock market authority).

The definitive terms of the Issuance will be announced by McPhy as soon as possible.

Placement agreement

The transaction will be the subject of a placement agreement to be concluded between the Lead Manager and bookrunner and the Company, covering all the shares offered. This contract will not constitute a performance guarantee within the meaning of Article L. 225-145 of the French Commercial Code. In the event of non-conclusion or termination of the placement agreement, subscription orders and the offer would be retroactively cancelled. The private placement is led by Gilbert Dupont, sole Lead Manager and bookrunner.

Lock-up commitments

As part of the Issuance, Bpifrance Investissement and EDF Pulse Croissance have signed a lock-up commitment covering all the Company shares they hold for a duration of 90 days from the settlement-delivery date, while the Company has signed an abstention commitment for a duration of 180 days from the settlement-delivery date.

Free warrant allocation

In order to allow all shareholders to participate in the planned issuance and benefit from the same subscription conditions, the Company wants to propose the free allocation of stock warrants (“BSA”) to all existing shareholders prior to the Issuance; in this respect, a right to BSA will be granted by Euronext to all shareholders of the Company on November 6, 2019. These warrants would allow their holders to subscribe to new shares at the Issuance price. One BSA would be allocated for each existing share held, and 10 BSA would allow their holder to subscribe to one new ordinary share.

Within this framework, Bpifrance Investissement and EDF Pulse Croissance have pledged to vote in favor of the Shareholders’ Meeting resolution regarding the issuance of these BSA, which will be voted on at an Extraordinary Shareholders’ Meeting which will be held on January 16, 2020. In the event of a favorable vote, a Board of Directors of the Company will meet on the same day at the end of the Extraordinary General Meeting in order to allocate the warrants to the Company’s shareholders who have benefited from this right. Bpifrance Investissement and EDF Pulse Croissance have also agreed not to exercise any BSA they may be allocated.

Should the BSA be fully exercised, the resulting issuance of new shares would represent 7.1% of the Company’s current share capital.

The BSA would not be admitted to the negotiations.

Universal Registration Document and forward-looking statements

Detailed information on the Company, in particular with regard to its business, results, outlook and corresponding risk factors, can be found in the Company’s Universal Registration Document filed with the Autorité des Marchés Financiers (the “AMF”) on November 4, 2019 under number D.19-0926 which may be consulted, as well as other regulated information relating to the Company (including its 2018 audited financial statements and its half-yearly financial statements as at 30 June 2019), all of the Company’s press releases and the investor presentation, on the Company’s website (www.mcphy.com).

This press release contains forward-looking statements. These statements are not guarantees of McPhy’s future performance. This forward-looking information relates to McPhy’s future prospects, evolution and business strategy and is based on the analysis of future earnings forecasts and market data estimates. By its nature, forward-looking information involves risks and uncertainties because it relates to events and depends on circumstances that may or may not occur in the future. McPhy draws investors’ attention to the fact that forward-looking statements are not guarantees of its future performance and that its actual financial position, results and cash flows and developments in the industry in which McPhy operates may differ materially from those proposed or suggested by the forward-looking statements contained in this document. In addition, even if McPhy’s financial position, results, cash flows and developments in the industry in which McPhy operates were consistent with the forward-looking information contained in this document, such results or developments may not be a reliable indication of McPhy’s future results or developments. The disclosure of forward-looking statements in this press release does not relieve the Company of its obligations under Regulation (EU) No. 596/2014 of 16 April 2014 on Market Abuse (“MAR Regulation”).

Risk factors

The Company draws investors’ attention to the risk factors presented in Chapter 4 of the Universal Registration Document; the occurrence of all or some of these risks is likely to have an adverse effect on the Company’s business, financial position, results or ability to achieve its objectives.

The Company also draws investors’ attention to the main specific risks related to the securities to be issued:

(i) Dilution: Shareholders who do not subscribe to this capital increase will have their shareholding in the Company’s share capital diluted. In the event of a new market call, this would result in additional dilution for shareholders;

(ii) Liquidity: The market price and liquidity of the Company’s shares could fluctuate significantly;

(iii) Risks related to the transaction: The Company may require additional financing. It is specified that the Group’s consolidated net working capital is sufficient to meet its current obligations over the next 12 months.

The information contained in the Universal Registration Document and this press release makes it possible to maintain, in all material respects and as necessary, equal access to information relating to the Company for the various shareholders and investors.

Projected timeline

November 5, 2019

Press release from the Company announcing the availability of the Universal Registration Document

Press release from the Company announcing the principle of the Reserved Capital Increase

No later than November 7, 2019 before market opening

Conclusion of the placement agreement

Press release from the Company announcing the completion of the Reserved Capital Increase

Allocation of the right to the allocation of warrants

No later than November 8, 2019

Approval of the Prospectus by the AMF and press release by the Company on the terms and conditions for making it available

No later than November 12, 2019

Reception of the subscription price – Issuance of the New Shares and settlement-delivery of the New Shares

Board of Directors of the Company acknowledging the completion of the Reserved Capital Increase

Euronext notice relating to the admission of the New Shares to trading on Euronext Paris

No later than December 12, 2019

Convocation of the Extraordinary General Meeting

January 16, 2020

Extraordinary General Meeting concerning in particular the allocation of warrants

Meeting of the Board of Directors

Trading suspension

The Company informs that it has requested Euronext Paris to suspend the trading of its shares as from Tuesday, November 5 before market opening.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

DISCLAIMER

This announcement and the information contained herein do not constitute either an offer to sell or purchase, or the solicitation of an offer to sell or purchase, securities of McPhy in France, in the United States or in any other jurisdiction for the purpose of a public offering transaction.

The distribution of this document may be restricted by law in certain jurisdictions. Persons into whose possession this document comes are required to inform themselves about and to observe any such restrictions.

This announcement is an advertisement and not a prospectus within the meaning of the Directive 2003/71/CE of the European Parliament and of the Council of 4 November 2003, as amended by (the “Prospectus Regulation”).

With respect to the Member States of the European Economic Area (including France) (“Member States”), no action has been or will be undertaken to make an offer to the public of the securities referred to herein requiring a publication of a prospectus in any Member State. As a result, the securities of the Company may not and will not be offered in any Member State except in accordance with the exemptions set forth in Article 3(2) of the Prospectus Regulation, or under any other circumstances which do not require the publication by the Company of a prospectus pursuant to Article 3 of the Prospectus Regulation and/or to applicable regulations of that relevant Member State.

For the purposes of the provision above, the expression “offer to the public” in relation to any shares of the Company in any Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor to decide to purchase any securities, as the same may be varied in that Member State.

This document does not constitute an offer to the public in France and the securities referred to in this document can only be offered or sold in France pursuant to Article L. 411-2-II of the French Code monétaire et financier to (i) providers of third party portfolio management investment services, (ii) qualified investors (investisseurs qualifiés) acting for their own account and/or (iii) a limited group of investors (cercle restreint d’investisseurs) acting for their own account, all as defined in and in accordance with Articles L. 411-1, L. 411-2 and D. 411-1 to D. 411-4 and D. 754-1 and D. 764-1 of the French Code monétaire et financier. In addition, in accordance with the autorization granted by the general meeting of the Company’s shareholders dated January 18, 2019, only the persons pertaining to the categories specified in the 5 th resolution of such general meeting may subscribe to the offering.

The distribution of this press release is only being distributed to, and is only directed at persons in the United Kingdom, subject to applicable laws, (i) persons having professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 as amended (the “Order”); (ii) high net worth bodies corporate, unincorporated associations and partnerships and trustees of high value trusts as described in Article 49(2) (a) to (d) of the Order or (iii) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of Article 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “Relevant Persons”). The Reserved Offering mentioned herein is only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire shares will be engaged in only with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on, this press release or any information contained herein.

This press release has been prepared on the understanding that the offer of securities referred to herein in any Member State of the European Union or the members of the European Economic Area Agreement who have transposed the Prospectus Directive, as defined below, (each, a “Concerned Member State”) will not require the publication of a prospectus in any Concerned Member State, and no action has been nor will be undertaken to allow the public offering of securities requiring the publication of a prospectus in any Concerned Member State. As a result, any person offering or intending to offer, in any Concerned Member State, the securities that are the subject of the Reserved Offering described herein may not do so except in a manner that will not create any obligation on the part of McPhy or the Managers mentioned herein to publish a prospectus with respect to such offer under Article 3 of the Prospectus Directive, as modified by Prospectus Directive Amendment 2010/73/UE. Neither McPhy nor any of the Managers has authorized, nor will authorize, any offer of the securities mentioned referred to herein in circumstances that would result in the obligation on the part of McPhy or any of the Managers to publish a prospectus in connection with such offer.

This press release does not constitute a prospectus within the meaning of the Prospectus Directive.

This press release may not be distributed, directly or indirectly, in the United States. This press release does not constitute an offer of securities for sale or the solicitation of an offer to purchase securities in the United States or any other jurisdiction where such offer may be restricted. Securities may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933, as amended (the “Securities Act”), except pursuant to an exemption from, or in a transaction not subject to, the registration requirements thereof. The securities of McPhy have not been and will not be registered under the Securities Act and McPhy does not intend to make a public offering of its securities in the United States, Canada, Australia or Japan. Copies of this document are not being, and should not be, distributed in or sent into the United States.

Investors may not accept an offer of securities referred to herein, nor acquire such securities, unless on the basis of information contained in the Prospectus. This announcement cannot be used as basis for any investment agreement or decision.This press release may not be distributed, directly or indirectly, in or into the United States, Canada, Australia or Japan.

The Managers are acting as financial advisers to the Company and no-one else and will not be responsible to anyone other than the Company for providing the protections afforded to customers of the Managers or for providing advice in relation to this communication or any other matter contemplated herein.

McPhy announces the appointment of Laurent Carme as CEO in a dynamic commercial environment

La Motte-Fanjas (France), October 2, 2019 – 5:45 pm CEST – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329) a specialist in hydrogen production and distribution equipment, announces that the Board Meeting held on October 1st has decided to establish a separate governance structure in accordance with the recommendations of the Appointments and Remuneration Committee, set up to prepare for the succession at the head of the Group, and in accordance with governance best practices. In this context, Laurent Carme has been appointed Chief Executive Officer of McPhy. He succeeds to Pascal Mauberger, who keeps his position as Chairman of the Board of Directors. Laurent Carme’s mandate will be effective on November 4, 2019.

Pascal Mauberger headed the company as Chairman of the Management Board and then Chief Executive Officer for the last 11 years. With a team from the CNRS scientific research center, he founded McPhy in 2008 and made it one of the French and European hydrogen sector’s flagship startups. Pascal Mauberger then led the transformation of McPhy, which in ten years, has positioned itself among the leaders in France and Europe in decarbonated hydrogen. The Board of Directors warmly thanks Pascal Mauberger for this remarkable entrepreneurial achievement, for the work accomplished at the head of McPhy’s teams and for his commitment during this founding decade.

Laurent Carme, 43, began his career as a consultant at Estin & Co before joining L.E.K. Consulting, where he carried out numerous growth strategy and industrial strategy missions in the energy and transport sectors.

In 2009, he joined Alstom Renewables, where he headed the Business Development division in Paris. Laurent Carme was then appointed, in Barcelona, Vice President Wind Onshore Platform and then Vice President Wind Engineering and Strategic Sourcing. During his time in Spain, he contributed his expertise to onshore and offshore product lines, and notably the development of products and cost-cutting projects.

In 2015, Laurent Carme joined GE Renewable Energy as President of GE Hydro France and Head of the Grenoble site (800 employees), in charge of global R&D, engineering, project management and production activities for the Hydroelectric division. Since 2018, Laurent Carme has headed the Power Transformers division at GE Grid Solutions ($700 million / 2,700 staff worldwide). He graduated from École Polytechnique and École Nationale des Ponts et Chaussées.

This appointment comes in a dynamic commercial context for the company, which received an order for a 1 MW electrolyzer from Hynamics (EDF) in September as part of the Commercial Industrial and R&D partnership signed in 2018. This new order brings to over €10 million the number of orders booked between January 1st and the end of September 2019.

Pascal Mauberger, Chairman of McPhy’s Board of Directors, states: “It is with confidence and much pleasure that I am handing over the position of CEO to Laurent Carme. With his substantial experience in renewable energies, both in wind and hydroelectric power in France and abroad, Laurent Carme is an experienced and acknowledged leader who will steer McPhy through another decisive phase in its development, characterized by an acceleration in the international roll-out of its activities and the achievement of financial break even.”

Laurent Carme, Chief Executive Officer of McPhy, states: “I warmly thank the Board of Directors and Pascal Mauberger for the trust they have placed in me through this appointment. By joining McPhy, I am glad to pursue a 10-year commitment to the energy transition. The growth potential of both hydrogen and McPhy is huge and I am enthusiastic to be able to contribute to it with all the women and men of McPhy.”

Upcoming financial communication

2019 annual revenues: Tuesday January 28, 2020, after market.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40