2021 Annual Results

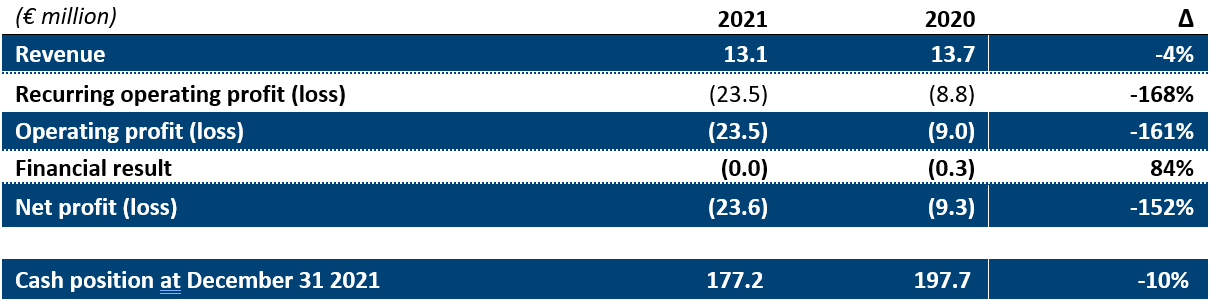

• 2021 Revenue: €13.1 million

• Operating loss: €23.5 million

• Strong cash position of €177.2 million as of December 31, 2021

• Commitment to a strategic and structured CSR approach

• Growth and continuation of industrialization expected in 2022

La Motte-Fanjas, March 08, 2022 – 5:45 pm CET – McPhy (Euronext Paris, C Compartment: MCPHY, FR0011742329), a specialist in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), today announces its results for the financial year 2021, ended December 31, approved today by the Company’s Board of Directors.

The implementation of our scaling-up strategy, coupled with a solid financial situation and the full commitment of our teams, reinforce the Group’s confidence in its growth outlook.

Jean-Baptiste Lucas, CEO of McPhy, states: “After a fiscal year 2021 marked by a delay in the launch of major projects and the management of an industrial incident, McPhy starts 2022 with a strengthened organization and a significantly increased backlog. The Group is back on track to win new business and is ready to deploy its project portfolio thanks to industrialization efforts that will be further intensified during the year. Among our major projects are the strengthening of our industrial infrastructure in France and Italy; and the work on the attractiveness of the Group in a context of rapid and strong growth in the workforce. At the same time, McPhy is committed to a strategic and structured CSR approach, fully consistent with the Group’s business model, based on supporting national and European customers in their decarbonation processes. The year 2022 promises to be full of technological and industrial challenges. The implementation of our scaling-up strategy, coupled with a solid financial situation and the full commitment of our teams, reinforce the Group’s confidence in its growth outlook.”

Recovery of activity in the second half of the year

The revenue for the 2021 fiscal year amounts to €13.1 million compared to €13.7 million in 2020. The expected growth for the year was slowed down in the first half of the year by the wait-and-see attitude of certain stakeholders dependent on public financing mechanisms.

The revenue is composed at 55% by the supply of electrolyzers (39% for the McLyzer large capacity electrolyzers and 16% for the Piel range) and at 45% by the McFilling hydrogen stations.

Commercial momentum rebounded significantly in the second half of the year, with the signing of several firm orders (1) such as the R-Hynoca project (2), which aims to set up the first hydrogen station in Strasbourg; the Centrale Électrique de l’Ouest Guyanais (3) (“CEOG”) project, which combines photovoltaic energy and massive electricity storage, mainly in the form of hydrogen; and an order for the supply of a large capacity hydrogen station in the west of France (4).

McPhy has also been selected as a preferred partner (5) in various projects, with the signing of a Memorandum of Understanding for the “Carlentini” project with Enel Green Power (6); the selection of McPhy as a preferred supplier to equip the GreenH2Atlantic project (7) in Sines, Portugal, with a 100 MW electrolysis platform. The strategic partnership with Hype, announced last December 12, which involves the supply of a 2 to 4 MW alkaline electrolyzer and an 800 kg/day station, has not yet been formalized and is still under discussion.

Firm orders booked during the year amounted to €19 million, bringing the backlog to €20 million as of December 31, 2021, an increase of +30% compared to the previous year.

The total number of contracts for which McPhy has been selected or identified as a preferred partner to date brings its references to 191 MW and 95 stations.

Operating loss in line with expectations, cash position still very strong

Taking into account the development efforts, including a sharp increase in staff costs, necessary for the transition to industrial scale, and the financial impact of the potassium hydroxide leak on equipment installed in Grenzach-Wyhlen, Germany, for a total amount of €5 million (8), the operating loss for fiscal year 2021 is €(23.5) million, lower than the forecast of €(25) million announced in the annual revenue press release (9).

The Company’s particularly healthy financial position and balance sheet contributes to limiting financial expenses with a net result of €(23.6) million.

The change in cash and cash equivalents was €(20.5) million, in line with the Group’s forecasts, and breaks down into negative operating cash flow of €(11.3) million, capital expenditure of €(5.1) million, of which nearly €(3.5) million related to research and innovation and €4 million related to the repayment of a State Guaranteed Loan (“PGE Prêt Garanti d’Etat”).

As of December 31, 2021, the Group holds a cash position of €177 million. This solid financial position and the support of leading investors and technological and commercial partners allow McPhy to continue to implement its change of scale. The Group continues to deploy its commercial roadmap, its major industrialization projects, and its structuring, through the financing of human, technological and industrial growth plans appropriate to a leader in the hydrogen industry.

Recruitment plan successfully completed, strategic partnerships set up

In a tight job market and in a field where key skills are in high demand, McPhy reached its recruitment target with 44 new employees joining the Group in fiscal year 2021, notably in highly technical positions, 75% of which are in direct functions (engineers, technicians, operators, etc.). This active recruitment approach is part of the Group’s global “Invest in Our People” strategy, which consists of the retention and development of the Group’s talents and the strengthening of the Company’s attractiveness for its existing and future employees.

Furthermore, in a sector logic, the Group focused on strengthening its technological and commercial positioning through the deployment of its partnership strategy. McPhy signed several agreements with major stakeholders in the hydrogen ecosystem, such as those signed with TSG (10), Plastic Omnium (11) or Hype (12). This strategy aims both to build a decarbonized hydrogen offer by relying on a network of leading partners, and to develop an industrialized and standardized approach in order to increase the competitiveness of hydrogen, both for mobility-related uses and for industrial uses. This strategy has also been deployed with some of the Group’s strategic shareholders, such as Hynamics, an EDF subsidiary dedicated to hydrogen, and Technip Energies, in order to compete in large-scale calls for tenders.

Commitment to a strategic and structured CSR approach

By definition, McPhy’s business model is based on supporting national and European customers in the industry, mobility and energy sectors in their decarbonation trajectories. The Group is thus participating in the energy transition and decided to commit to a strategic and structured CSR approach, fully consistent with the Group’s business model.

At the end of 2021, McPhy decided, in a proactive logic both ambitious and pragmatic, to formalize and structure its CSR commitment in a continuous improvement process. Consequently, the Group initiated a CSR/ESG diagnostic with the objective of defining a McPhy roadmap by 2025. A dedicated governance has been established. The CSR committee is in charge of the implementation of this roadmap; the first results and updated objectives of this strategy will be disclosed as of the second half of 2022.

Outlook

Thanks to the positive trend in its backlog, McPhy expects to return to sustained growth in its business in 2022, although the pace will continue to depend on the execution speed of projects that are still subject to regulatory and technical uncertainties.

A strategic diagnosis carried out by McPhy at the beginning of the year confirmed the relevance of its main technological orientations, and in particular its priority positioning on pressurized alkaline electrolysis as the most suitable green hydrogen production method for large-scale projects. The Group intends to pursue its R&D efforts and accelerate the scaling up of its industrial facilities.

Concerning the electrolyzers segment, the Group has launched work to extend the production capacity of its industrial site based in San Miniato, Italy. The construction of a Gigafactory for electrolyzers, for which the Belfort site has been pre-selected, remains, notably, conditional on obtaining financing under the IPCEI. Initially planned for the end of 2021, the final investment decision should be made by the end of the first half of 2022.

Concerning hydrogen stations segment, McPhy is working on the development of its new production site based in Grenoble. McPhy will take possession of the site in the spring of 2022 and will begin a relocation in several phases during the second quarter.

Excluding the Gigafactory, industrial investments should represent nearly €4 million in 2022.

This industrialization effort is combined with an investment in human resources, as illustrated by the planned hiring of 60 additional employees in 2022. McPhy aims to double its workforce between fiscal year 2020 and 2022, in critical functions designed to support the Group’s transition to industrial scale.

It should be noted that the Russian-Ukrainian conflict and related geopolitical tensions could have consequences of all kinds that could impact McPhy’s outlook.

Footnotes

(1) Orders with signed purchase orders

(2) https://mcphy.com/en/press-releases/mcphy-will-equip-the-r-hynoca-project-in-strasbourg/

(3) https://mcphy.com/en/press-releases/ceog-project/

(4) https://mcphy.com/en/press-releases/new-contract-large-capacity-hydrogen-station/

(5) Preferred partner and subject to the project’s success, considering that some of these projects should have an impact on the revenue as of 2023

(6) https://mcphy.com/en/press-releases/cooperation-agreement-with-enel-green-power/

(7) https://mcphy.com/en/press-releases/greenh2atlantic-project/

(8) This amount includes all expenses related to the incident itself, provisioned as of June 30, 2021, as well as the cost of preventive measures to replace stacks currently being deployed among a small number of customers equipped with a similar first-generation electrolyzer model.

(9) https://mcphy.com/en/press-releases/mcphy-announces-2021-full-year-revenue/

(10) https://mcphy.com/en/press-releases/strategic-partnership-with-tsg/

(11) https://mcphy.com/en/press-releases/technological-partnership-with-plastic-omnium/

(12) https://mcphy.com/en/press-releases/signature-of-a-strategic-partnership-with-hype/

Next financial communications:

• Annual General Meeting, on May 19, 2022

• 2022 First-Half Results, on July 28, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu