Capital increase by private placement

La Motte Fanjas (France), November 7, 2019 – 7:30 am CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), a specialist in hydrogen production and distribution equipment, today announces the success of a capital increase via the issuance of new ordinary shares without preferential subscription rights (the “Issuance”).

The Company has placed 2,552,544 new shares with a par value of €0.12 per share, at a unit price of €2.70, including the issuance premium, for a total amount of approximately €6.9 million (1), representing 17.3% of the Company’s share capital.

The strengthening of shareholders’ equity will enable us to accelerate the roll-out of our international activities and pursue our development strategy.

Laurent Carme, Chief Executive Officer of McPhy, states: “We sincerely thank all the investors who made this transaction a success in a difficult market environment, and in particular the Ecotechnologies Fund, managed by Bpifrance Investissement, and EDF Pulse Croissance Holding, who have renewed their confidence in the Company. The strengthening of shareholders’ equity will enable us to accelerate the roll-out of our international activities and pursue our development strategy.”

The funds raised will enable McPhy to strengthen its shareholders’ equity and finance its working capital requirements, in a context of revenue growth:

- One-third of the funds will allow the Company to participate in covering its working capital requirements for the next 18 months;

- One-third of the funds will be dedicated to address the acceleration of the activity, the market and ongoing projects, in particular with regard to very high capacity hydrogen production platforms; and

- One-third of the funds will be dedicated to financing R&D and product development so that the Company can begin the industrialization phase of its equipment.

McPhy is already anticipating revenue growth of around 40% in 2019 compared with 2018, i.e. 2019 revenue of at least €11 million. Moreover, as indicated in its Universal Registration Document, McPhy has received a conditional order intent and has entered into exclusive negotiations for the construction and commissioning of a 20 MW electrolyser platform to be installed in Europe; the first phase being the engineering contract.

As part of this capital increase without preferential subscription rights, the subscription price of McPhy shares was set at €2.70 per share (including the issuance premium), corresponding to a discount of 20.1% compared to the closing price on November 4, 2019 and 19.1% compared to the volume-weighted average price of McPhy share on the Euronext Paris regulated market during the last three trading days before the fixing of the issuance price.

This operation is completed pursuant to article L. 225-138 of the French Commercial Code and by virtue of the fifteenth resolution of the Combined Shareholders’ Meeting of May 23, 2019.

Following the transaction, McPhy will issue 2,552,544 new ordinary shares, bringing the total number of McPhy shares to 17,325,851 shares.

The issued shares represent 17.3% of the capital and voting rights before the Issuance, and 14.7% after the Issuance. As an indication, the participation of a shareholder holding 1% of McPhy’s share capital prior to the issuance and who did not participate in the issuance will be reduced to 0.85% at the end of the operation.

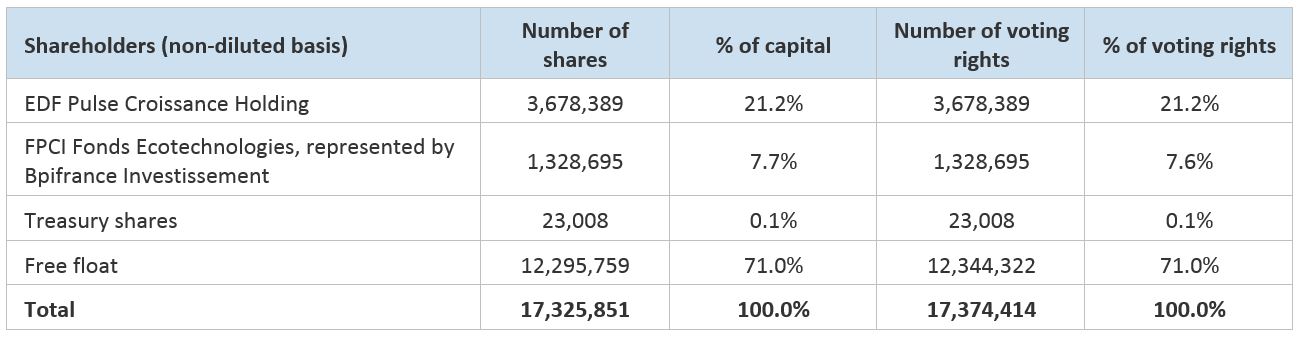

Following this capital increase and on the basis of the information available to the Company, the breakdown of the capital is as follows:

The new shares will be assimilated to the existing shares and will carry current dividend rights. They will be listed on the Euronext market on the same listing line as the existing shares under ISIN code FR0011742329. The settlement-delivery of the new shares issued as part of the private placement and their admission to trading on the Euronext regulated market in Paris are scheduled for November 12, 2019. The new shares will have full dividend rights.

As part of the transaction, the Ecotechnologies Fund, managed by Bpifrance Investissement as part of the Future Investment Program (“Programme d’Investissements d’Avenir”) and EDF Pulse Croissance Holding have signed a lock-up commitment covering all the Company shares they hold for a duration of 90 days from the settlement-delivery date, while the Company has signed an abstention commitment for a duration of 180 days from the settlement-delivery date.

The private placement was led by Gilbert Dupont, sole Lead Manager and bookrunner. The transaction was the subject of a placement agreement entered into on November 7, 2019 between the Lead Manager and bookrunner and the Company, covering all the offered shares. This agreement does not constitute a performance guarantee within the meaning of Article L. 225-145 of the French Commercial Code. In the event of termination of the placement agreement, subscription orders and the offer would be retroactively cancelled.

Free warrant allocation

In order to allow all shareholders to participate in the planned issuance and benefit from the same subscription conditions, the Company wants to propose the free allocation of stock warrants (“BSA (2)”) to all existing shareholders prior to the Issuance; in this respect, a right to BSA will be granted by Euroclear to all shareholders of the Company as of November 6, 2019. These warrants would allow their holders to subscribe to new shares at the Issuance price, i.e. €2.70 per new share. One BSA would be allocated for each existing share held, and 10 BSA would allow their holder to subscribe to one new ordinary share.

Within this framework, the Ecotechnologies Fund and EDF Pulse Croissance Holding have pledged to vote in favor of the Shareholders’ Meeting resolution regarding the issuance of these BSA, which will be voted on at an Extraordinary Shareholders’ Meeting which will be held on January 16, 2020. In the event of a favorable vote, a Board of Directors of the Company will meet on the same day at the end of the Extraordinary General Meeting in order to allocate the warrants to the Company’s shareholders who have benefited from this right. The Ecotechnologies Fund and EDF Pulse Croissance Holding have also agreed not to exercise any BSA they may be allocated.

The full exercise of the warrants would result in the creation of 1,048,013 new shares and would result in a 6% dilution of the share capital and voting rights after the Issuance (3).

The BSA would not be admitted to the negotiations.

Universal Registration Document and forward-looking statements

Detailed information on the Company, in particular with regard to its business, results, outlook and corresponding risk factors, can be found in the Company’s Universal Registration Document filed with the Autorité des Marchés Financiers (4) (the “AMF“) on November 4, 2019 under number D.19-0926 which may be consulted, as well as other regulated information relating to the Company (including its 2018 audited financial statements and its half-yearly financial statements as at 30 June 2019), all of the Company’s press releases and the investor presentation, on the Company’s website (www.mcphy.com).

This press release contains forward-looking statements. These statements are not guarantees of McPhy’s future performance. This forward-looking information relates to McPhy’s future prospects, evolution and business strategy and is based on the analysis of future earnings forecasts and market data estimates. By its nature, forward-looking information involves risks and uncertainties because it relates to events and depends on circumstances that may or may not occur in the future. McPhy draws investors’ attention to the fact that forward-looking statements are not guarantees of its future performance and that its actual financial position, results and cash flows and developments in the industry in which McPhy operates may differ materially from those proposed or suggested by the forward-looking statements contained in this document. In addition, even if McPhy’s financial position, results, cash flows and developments in the industry in which McPhy operates were consistent with the forward-looking information contained in this document, such results or developments may not be a reliable indication of McPhy’s future results or developments.

The Company draws investors’ attention to the risk factors presented in Chapter 4 of the Universal Registration Document; the occurrence of all or some of these risks is likely to have an adverse effect on the Company’s business, financial position, results or ability to achieve its objectives.

The Company also draws investors’ attention to the main specific risks related to the securities to be issued:

(i) Dilution: Shareholders who do not subscribe to this capital increase will have their shareholding in the Company’s share capital diluted. In the event of a new market call, this would result in additional dilution for shareholders;

(ii) Liquidity: The market price and liquidity of the Company’s shares could fluctuate significantly;

(iii) Risks related to the transaction: The Company may require additional financing. It is specified that the Group’s consolidated net working capital is sufficient to meet its current obligations over the next 12 months.

The information contained in the Universal Registration Document and this press release makes it possible to maintain, in all material respects and as necessary, equal access to information relating to the Company for the various shareholders and investors.

Projected timeline

November 7, 2019

Allocation of the right to the allocation of warrants by Euroclear

November 12, 2019

Reception of the subscription price – Issuance of the New Shares and settlement-delivery of the New Shares

Board of Directors of the Company acknowledging the completion of the Issuance

Euronext notice relating to the admission of the New Shares to trading on Euronext Paris

No later than December 12, 2019

Convocation of the Extraordinary General Meeting

January 16, 2020

Extraordinary General Meeting concerning in particular the allocation of warrants

Meeting of the Board of Directors

Trading suspension

The Company recalls that it has requested Euronext Paris to suspend the trading of its shares as from Tuesday, November 5 before market opening. McPhy share trading will resume on November 7, 2019 at market opening.

(1) Before exercise of stock warrants (“BSA”, Bons de souscription d’actions in French), please read the dedicated paragraph.

(2) Bons de souscription d’actions in French.

(3) Subject to the allocation of the warrants.

(4) French stock market authority.

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production, storage and distribution equipment, McPhy contributes to the deployment of clean hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the hydrogen energy, zero emission mobility and industrial hydrogen markets, McPhy provides turnkey solutions to its clients. These solutions are tailored to our client applications: renewable energy surplus storage and valorization, fuel cell car refueling, raw material for industrial sites.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.fr

Investor relations

NewCap

Julie Coulot | Emmanuel Huynh

T. +33 (0)1 44 71 20 40

mcphy@newcap.fr