La Motte-Fanjas, April 29, 2022 – 9:00 am CEST – McPhy (Euronext Paris, C Compartment: MCPHY, FR0011742329), a specialist in zero-carbon hydrogen production and distribution equipment (electrolyzers and recharging stations), announces today having made available to the public and filed with the “Autorité des marchés financiers”, on 28 April 2022, its 2021 Universal Registration Document, under number D.22-0381.

This Universal Registration Document includes in particular:

- The annual Financial Report for 2021;

- The management report ;

- The Board of Directors’ report on corporate governance;

- The reports of the Statutory Auditors and their fees.

The presentation of the agenda and resolutions of the Annual General Meeting of 19 May, 2022, is included in the report of the Board of Directors to the General Meeting which is available on the company’s website.

The Universal Registration Document is available free to the public at the Company’s registered office, 1115, route de Saint-Thomas, 26190 La Motte-Fanjas, upon request and may also be consulted on the websites of the AMF (www.amf-france.org) or the Company (www.mcphy.com/en).

Upcoming of financial communication events

• Annual General Meeting on May 19, 2022

• Publication of half-yearly results on July 28, 2022 after market close

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy signs a first order with Hype as part of their strategic partnership

McPhy will equip, in Île-de-France region, the Hype’s hydrogen station network with a 2 MW alkaline electrolyzer and an 800 kg / day Dual Pressure station

La Motte-Fanjas, April 25, 2022 – 05:45 pm CEST – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announces that it has finalized its strategic partnership agreement with Hype, key player in light and heavy hydrogen mobility, whose principles were described by McPhy in its press release of December 14, 2021 (1).

As part of this agreement, McPhy subscribed on April 22 to €12 million of convertible bonds issued by Hype, with a capitalized interest rate of 4.5% and a maturity of 9 years. These bonds may be converted into Hype shares, before their maturity date, under certain conditions and in limited cases for a period of two years, including a change of control, an IPO or an issuance of securities in excess of €10 million.

In this context, a first order was signed with Hype, for the supply of a 2 MW alkaline electrolyzer and a Dual Pressure station with a capacity of 800 kg per day, which will be installed in the Paris region. Two additional very large-capacity stations are expected to be ordered by June 30, 2022.

Further commercial opportunities are expected to arise from this partnership with the establishment by the end of 2022 of a co-exclusive framework agreement between Hype and McPhy. This agreement covers the deployment by Hype of a minimum of 100 stations in France and Europe, of which 50% would be allocated to McPhy, and 15 to 25 MW of alkaline electrolysis.

Next financial events

- Annual General Meeting, on May 19, 2022

- 2022 First-Half Results, on July 28, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy announces 2021 annual Results

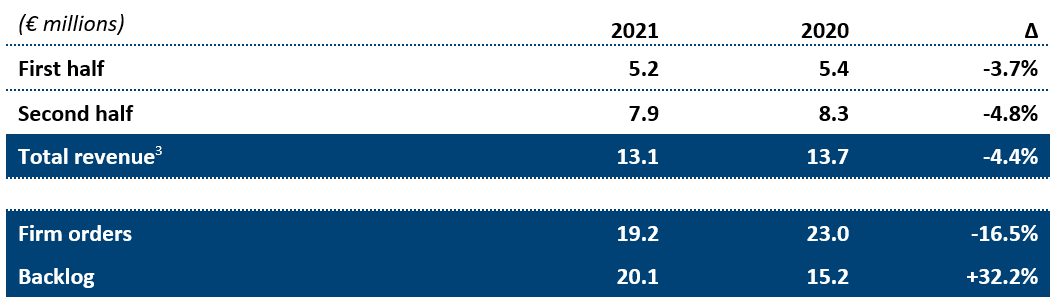

• 2021 Revenue: €13.1 million

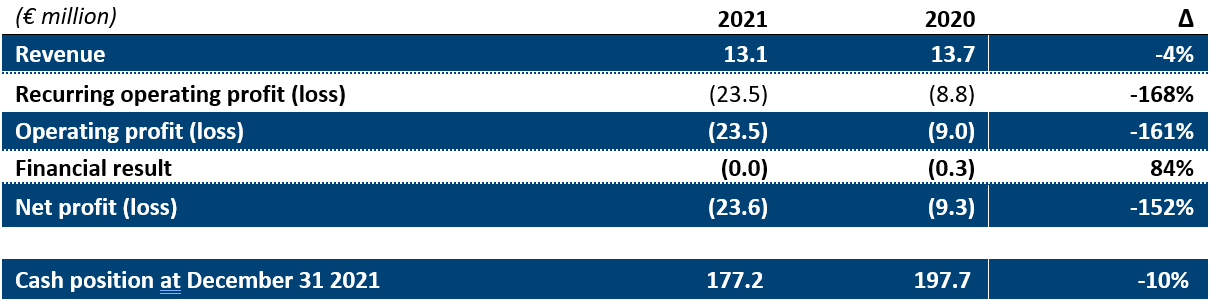

• Operating loss: €23.5 million

• Strong cash position of €177.2 million as of December 31, 2021

• Commitment to a strategic and structured CSR approach

• Growth and continuation of industrialization expected in 2022

La Motte-Fanjas, March 08, 2022 – 5:45 pm CET – McPhy (Euronext Paris, C Compartment: MCPHY, FR0011742329), a specialist in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), today announces its results for the financial year 2021, ended December 31, approved today by the Company’s Board of Directors.

The implementation of our scaling-up strategy, coupled with a solid financial situation and the full commitment of our teams, reinforce the Group’s confidence in its growth outlook.

Jean-Baptiste Lucas, CEO of McPhy, states: “After a fiscal year 2021 marked by a delay in the launch of major projects and the management of an industrial incident, McPhy starts 2022 with a strengthened organization and a significantly increased backlog. The Group is back on track to win new business and is ready to deploy its project portfolio thanks to industrialization efforts that will be further intensified during the year. Among our major projects are the strengthening of our industrial infrastructure in France and Italy; and the work on the attractiveness of the Group in a context of rapid and strong growth in the workforce. At the same time, McPhy is committed to a strategic and structured CSR approach, fully consistent with the Group’s business model, based on supporting national and European customers in their decarbonation processes. The year 2022 promises to be full of technological and industrial challenges. The implementation of our scaling-up strategy, coupled with a solid financial situation and the full commitment of our teams, reinforce the Group’s confidence in its growth outlook.”

Recovery of activity in the second half of the year

The revenue for the 2021 fiscal year amounts to €13.1 million compared to €13.7 million in 2020. The expected growth for the year was slowed down in the first half of the year by the wait-and-see attitude of certain stakeholders dependent on public financing mechanisms.

The revenue is composed at 55% by the supply of electrolyzers (39% for the McLyzer large capacity electrolyzers and 16% for the Piel range) and at 45% by the McFilling hydrogen stations.

Commercial momentum rebounded significantly in the second half of the year, with the signing of several firm orders (1) such as the R-Hynoca project (2), which aims to set up the first hydrogen station in Strasbourg; the Centrale Électrique de l’Ouest Guyanais (3) (“CEOG”) project, which combines photovoltaic energy and massive electricity storage, mainly in the form of hydrogen; and an order for the supply of a large capacity hydrogen station in the west of France (4).

McPhy has also been selected as a preferred partner (5) in various projects, with the signing of a Memorandum of Understanding for the “Carlentini” project with Enel Green Power (6); the selection of McPhy as a preferred supplier to equip the GreenH2Atlantic project (7) in Sines, Portugal, with a 100 MW electrolysis platform. The strategic partnership with Hype, announced last December 12, which involves the supply of a 2 to 4 MW alkaline electrolyzer and an 800 kg/day station, has not yet been formalized and is still under discussion.

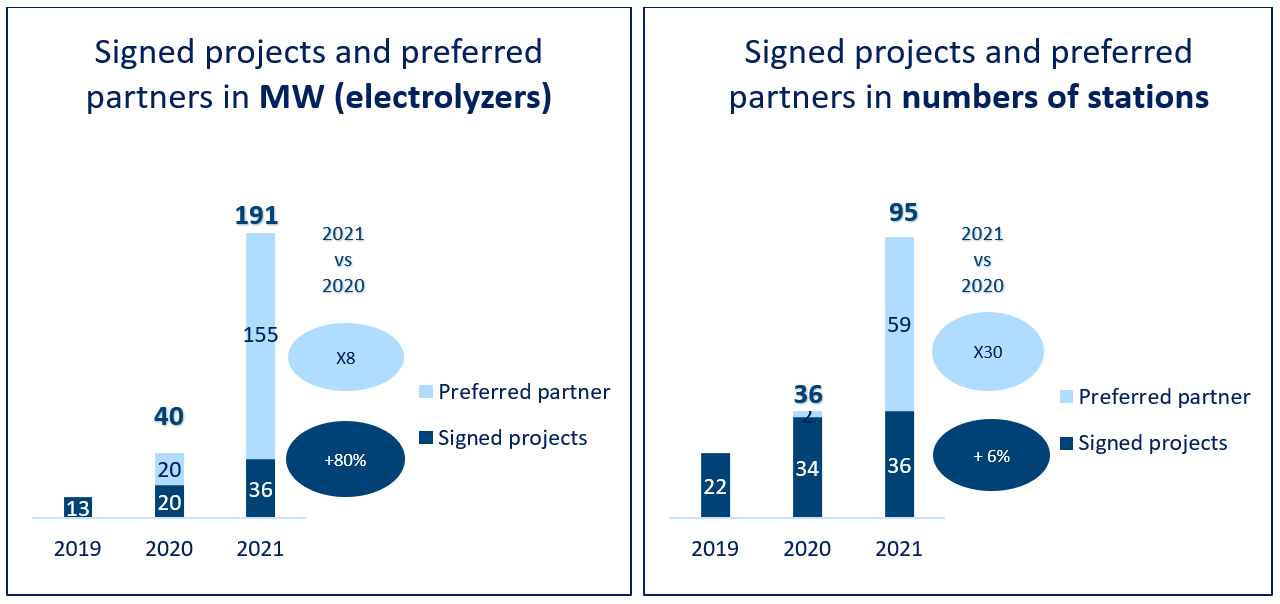

Firm orders booked during the year amounted to €19 million, bringing the backlog to €20 million as of December 31, 2021, an increase of +30% compared to the previous year.

The total number of contracts for which McPhy has been selected or identified as a preferred partner to date brings its references to 191 MW and 95 stations.

Operating loss in line with expectations, cash position still very strong

Taking into account the development efforts, including a sharp increase in staff costs, necessary for the transition to industrial scale, and the financial impact of the potassium hydroxide leak on equipment installed in Grenzach-Wyhlen, Germany, for a total amount of €5 million (8), the operating loss for fiscal year 2021 is €(23.5) million, lower than the forecast of €(25) million announced in the annual revenue press release (9).

The Company’s particularly healthy financial position and balance sheet contributes to limiting financial expenses with a net result of €(23.6) million.

The change in cash and cash equivalents was €(20.5) million, in line with the Group’s forecasts, and breaks down into negative operating cash flow of €(11.3) million, capital expenditure of €(5.1) million, of which nearly €(3.5) million related to research and innovation and €4 million related to the repayment of a State Guaranteed Loan (“PGE Prêt Garanti d’Etat”).

As of December 31, 2021, the Group holds a cash position of €177 million. This solid financial position and the support of leading investors and technological and commercial partners allow McPhy to continue to implement its change of scale. The Group continues to deploy its commercial roadmap, its major industrialization projects, and its structuring, through the financing of human, technological and industrial growth plans appropriate to a leader in the hydrogen industry.

Recruitment plan successfully completed, strategic partnerships set up

In a tight job market and in a field where key skills are in high demand, McPhy reached its recruitment target with 44 new employees joining the Group in fiscal year 2021, notably in highly technical positions, 75% of which are in direct functions (engineers, technicians, operators, etc.). This active recruitment approach is part of the Group’s global “Invest in Our People” strategy, which consists of the retention and development of the Group’s talents and the strengthening of the Company’s attractiveness for its existing and future employees.

Furthermore, in a sector logic, the Group focused on strengthening its technological and commercial positioning through the deployment of its partnership strategy. McPhy signed several agreements with major stakeholders in the hydrogen ecosystem, such as those signed with TSG (10), Plastic Omnium (11) or Hype (12). This strategy aims both to build a decarbonized hydrogen offer by relying on a network of leading partners, and to develop an industrialized and standardized approach in order to increase the competitiveness of hydrogen, both for mobility-related uses and for industrial uses. This strategy has also been deployed with some of the Group’s strategic shareholders, such as Hynamics, an EDF subsidiary dedicated to hydrogen, and Technip Energies, in order to compete in large-scale calls for tenders.

Commitment to a strategic and structured CSR approach

By definition, McPhy’s business model is based on supporting national and European customers in the industry, mobility and energy sectors in their decarbonation trajectories. The Group is thus participating in the energy transition and decided to commit to a strategic and structured CSR approach, fully consistent with the Group’s business model.

At the end of 2021, McPhy decided, in a proactive logic both ambitious and pragmatic, to formalize and structure its CSR commitment in a continuous improvement process. Consequently, the Group initiated a CSR/ESG diagnostic with the objective of defining a McPhy roadmap by 2025. A dedicated governance has been established. The CSR committee is in charge of the implementation of this roadmap; the first results and updated objectives of this strategy will be disclosed as of the second half of 2022.

Outlook

Thanks to the positive trend in its backlog, McPhy expects to return to sustained growth in its business in 2022, although the pace will continue to depend on the execution speed of projects that are still subject to regulatory and technical uncertainties.

A strategic diagnosis carried out by McPhy at the beginning of the year confirmed the relevance of its main technological orientations, and in particular its priority positioning on pressurized alkaline electrolysis as the most suitable green hydrogen production method for large-scale projects. The Group intends to pursue its R&D efforts and accelerate the scaling up of its industrial facilities.

Concerning the electrolyzers segment, the Group has launched work to extend the production capacity of its industrial site based in San Miniato, Italy. The construction of a Gigafactory for electrolyzers, for which the Belfort site has been pre-selected, remains, notably, conditional on obtaining financing under the IPCEI. Initially planned for the end of 2021, the final investment decision should be made by the end of the first half of 2022.

Concerning hydrogen stations segment, McPhy is working on the development of its new production site based in Grenoble. McPhy will take possession of the site in the spring of 2022 and will begin a relocation in several phases during the second quarter.

Excluding the Gigafactory, industrial investments should represent nearly €4 million in 2022.

This industrialization effort is combined with an investment in human resources, as illustrated by the planned hiring of 60 additional employees in 2022. McPhy aims to double its workforce between fiscal year 2020 and 2022, in critical functions designed to support the Group’s transition to industrial scale.

It should be noted that the Russian-Ukrainian conflict and related geopolitical tensions could have consequences of all kinds that could impact McPhy’s outlook.

Footnotes

(1) Orders with signed purchase orders

(2) https://mcphy.com/en/press-releases/mcphy-will-equip-the-r-hynoca-project-in-strasbourg/

(3) https://mcphy.com/en/press-releases/ceog-project/

(4) https://mcphy.com/en/press-releases/new-contract-large-capacity-hydrogen-station/

(5) Preferred partner and subject to the project’s success, considering that some of these projects should have an impact on the revenue as of 2023

(6) https://mcphy.com/en/press-releases/cooperation-agreement-with-enel-green-power/

(7) https://mcphy.com/en/press-releases/greenh2atlantic-project/

(8) This amount includes all expenses related to the incident itself, provisioned as of June 30, 2021, as well as the cost of preventive measures to replace stacks currently being deployed among a small number of customers equipped with a similar first-generation electrolyzer model.

(9) https://mcphy.com/en/press-releases/mcphy-announces-2021-full-year-revenue/

(10) https://mcphy.com/en/press-releases/strategic-partnership-with-tsg/

(11) https://mcphy.com/en/press-releases/technological-partnership-with-plastic-omnium/

(12) https://mcphy.com/en/press-releases/signature-of-a-strategic-partnership-with-hype/

Next financial communications:

• Annual General Meeting, on May 19, 2022

• 2022 First-Half Results, on July 28, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy announces 2021 full-year revenue

• 2021 Revenue: €13.1 million

• Strong commercial momentum in the second half of the year with a clear rebound in firm orders (1) and an increase of more than 30% in the backlog (2)

• Continued structuring and industrialization of the Group through the financing of HR, technological and industrial growth plans

• Strong financial position of €177 million as of December 31, 2021, despite an expected increase in the operating loss

La Motte-Fanjas, January 25, 2022 – 05:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announced today its full-year revenue for the year ending December 31, 2021, which stands at €13.1 million.

In a context of structuring hydrogen markets internationally, McPhy continues to implement its strategic roadmap and strengthens its position as a major industrial stakeholder in hydrogen for the energy transition.

Jean-Baptiste Lucas, CEO of McPhy, stated: “In a context of structuring hydrogen markets internationally, McPhy continues to implement its strategic roadmap and strengthens its position as a major industrial stakeholder in hydrogen for the energy transition. With a new governance structure, the Group is focused on the development of its industrial structure to scale up and address the growing needs of its markets, both in terms of number and size of projects. The return of strong commercial traction in the second half of the year proves this transition and the relevance of this ambition, even if the Group takes care to develop its production capacities in line with the maturity of the market. Strategic choices have been made, with the location of a new hydrogen station production site in Grenoble and the pre-selection of Belfort as the site for an electrolyzer Gigafactory. These industrial projects complement the production capacities based in Italy and engineering capacities based in Germany, establishing a strong European industrial footprint. Our teams are fully mobilized in the successful scaling up of McPhy and focused on customer satisfaction. The recruitment plan to support the Group’s growth has been completed, with nearly 50 new hires over the year. Our goal is to recruit more than 60 new employees by 2022, capitalizing on our attractiveness to secure the skills that will enable us to become a leader in the hydrogen sector.”

Strong sales momentum in the second half

As anticipated upon the announcement of the half-year results, the 2021 revenue stands at €13.1 million, compared to €13.7 million in 2020. The expected growth for the year was slowed down in the first half of the year, partly due to the global health context and related restrictions, and to the wait-and-see attitude of certain stakeholders dependent on public funding mechanisms.

The revenue is composed of 55% by the supply of electrolyzers (39% for McLyzer large capacity electrolyzers and 16% for the Piel range) and 45% by McFilling hydrogen stations.

Sales momentum rebounded sharply in the second half of the year, with the signing of several firm orders (1)such as:

- the R-Hynoca project (4), which aims to set up the first hydrogen station in Strasbourg. McPhy will provide a 350-750 bar dual-pressure refueling station with a distribution capacity of 700 kg per day, and a refueling point for pressurized hydrogen cylinders (“tube trailers”);

- the Western French Guiana Power Plant (5) (“CEOG”) project, the world’s largest combined photovoltaic power plant project with a massive storage of 128 MWh, mainly in hydrogen form. McPhy will supply the Augmented McLyzer 16 MW high power electrolyzer that will produce renewable hydrogen from water and green electricity generated by the photovoltaic park;

- an order for the supply of a large capacity hydrogen station in the west of France (6).

In addition, McPhy has been identified as preferred partner (7) in different projects:

- the signature of a Memorandum of Understanding with Enel Green Power (8) for the supply of a 4 MW pressurized alkaline electrolyzer from the Augmented McLyzer range to be connected to a renewable energy park in Carlentini, Sicily;

- the selection of McPhy as the preferred supplier to equip the GreenH2Atlantic project (9) in Sines, Portugal, with a 100 MW electrolysis platform;

- the signature of a strategic partnership with Hype the first part of which (supply of a 2 to 4 MW alkaline electrolyzer and a 800 kg/day station) could materialize in the first quarter of 2022, subject to the finalization of the legal documentation relating to the aforementioned strategic partnership. (10)

The increase in the volume of these large-scale projects reflects the resumption of tenders in the hydrogen sector. These new markets have fueled McPhy’s commercial portfolio, which has doubled in value in one year, despite the delay in the deployment of major public subsidy programs.

These commercial successes materialize in a firm order intake of €19 million, bringing the backlog to €20 million as of December 31, 2021, an increase of +30% compared to 2020. The total number of contracts for which McPhy has been selected or identified as a preferred partner to date brings its references to 191 MW and 95 stations.

Industrial scale-up, deployment of the partnership strategy and success of the recruitment campaign

In 2021, McPhy has also reached several milestones in the structuring of its industrial tool. In the hydrogen stations segment, McPhy will consolidate its R&D, engineering and production activities on a new site located in the heart of the Grenoble area. This site will be operational in spring 2022. The Group has also shortlisted Belfort as the location for its electrolyzer Gigafactory, whose construction remains conditional on obtaining financing under the IPCEI. Initially planned for the end of 2021, the final investment decision should be taken by the end of the first half of 2022.

The Group is committed to strengthening its offer through the deployment of its partnership strategy. McPhy has signed several agreements with major players in the hydrogen ecosystem, such as those with TSG (11), Plastic Omnium(12) or Hype (13). This strategy aims both to build a 360-degree decarbonized hydrogen offer by relying on a network of leading partners, and to develop an industrialized and standardized approach in order to increase the competitiveness of hydrogen, both in terms of mobility and industrial uses.

In 2021, McPhy has carried out an intensive recruitment campaign and strengthened its teams, a strategic pillar for the success of its scaling up. In line with the objective set, 44 employees, including 75% of direct functions (engineers, technicians, operators, etc.), joined the Company in highly technical positions. With a recruitment plan for 60 additional employees over the current financial year, the Group aims to double its workforce between 2020 and 2022, in positions designed to support the Company’s transition to industrial scale.

Strong financial position despite expected increase in operating loss

The operating loss for 2021 is expected to be around €-25 million. The increase in the operating loss is linked in particular to the structuring projects required for the transition to industrial scale currently being deployed. This result also includes the financial impact of the potassium hydroxide leak on an equipment installed in Grenzach-Wyhlen in Germany, for a total amount of nearly €5 million. This amount includes all expenses related to the incident itself, provisioned as of June 30, 2021, as well as the cost of preventive measures for the replacement of stacks being deployed with a few customers equipped with a similar first-generation electrolyzer model.

As of December 31, 2021, the Group reported a cash position of €177 million. This solid financial position and the support of leading investors and technology partners allow McPhy to pursue its commercial roadmap, its structuring and its industrialization, through the financing of HR, technological and industrial growth plans of a leader in the hydrogen industry.

Footnotes

(1) Orders with signed purchase orders

(2) Orders not yet recognized as revenue

(3) Unaudited figures as of the date of this document

(4) https://mcphy.com/en/press-releases/mcphy-will-equip-the-r-hynoca-project-in-strasbourg/

(5) https://mcphy.com/en/press-releases/ceog-project/

(6) https://mcphy.com/en/press-releases/new-contract-large-capacity-hydrogen-station/

(7) Preferred partner and subject to the project’s success, considering that some of these projects should have an impact on the revenue as of 2023

(8) https://mcphy.com/en/press-releases/cooperation-agreement-with-enel-green-power/

(9) https://mcphy.com/en/press-releases/greenh2atlantic-project/

(10) https://mcphy.com/en/press-releases/signature-of-a-strategic-partnership-with-hype/ (assumptions in the graph: 56 stations and 26 MW)

(11) https://mcphy.com/en/press-releases/strategic-partnership-with-tsg/

(12) https://mcphy.com/en/press-releases/technological-partnership-with-plastic-omnium/

(13) https://mcphy.com/en/press-releases/signature-of-a-strategic-partnership-with-hype/

Next financial event

• 2021 Full-Year Results, on March 8, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy signs a major contract with Eiffage Énergie Systèmes – Clemessy for a pioneering carbon-free mobility project in Belfort

• McPhy will equip a site in Belfort with a 1 MW electrolyzer and a refueling station distributing up to 800 kg per day, to fuel a fleet of hydrogen buses

• This innovative and modular installation is sized to address the growing number of uses and needs beyond urban mobility in the area

La Motte-Fanjas, January 17, 2022 – 05:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announces that it has signed a contract with Eiffage Énergie Systèmes – Clemessy (acting as agent), a subsidiary of the Eiffage Group, to equip a hydrogen production and distribution site located in Danjoutin, in the south of Belfort in France, operated by Hynamics (hydrogen subsidiary of the EDF Group). Equipped with an electrolyzer and a station, the site will initially be used to fuel low-carbon hydrogen to a fleet of 7 buses operated by the RTTB (“Régie des Transports du Territoire de Belfort”) on behalf of the SMTC (“Syndicat Mixte des Transports en Commun”) on the urban transport network Optymo. Commissioning is expected in spring 2023.

This project is a further illustration of McPhy’s commitment to become a key partner for local authorities in their transition to zero-emission mobility.

Jean-Baptiste Lucas, CEO of McPhy, stated: “This collaboration with the Eiffage Group, to supply hydrogen to the Belfort conurbation’s hydrogen-powered buses, with a possible opening to other types of vehicles and uses, is emblematic of the growing role played by hydrogen in urban mobility in France. This project is a further illustration of McPhy’s commitment to become a key partner for local authorities in their transition to zero-emission mobility.”

Delivery of a 1 MW electrolyzer and a modular, multi-terminal refueling station

As part of this contract, McPhy will deliver the equipment for the installation, consisting of a 1 MW McLyzer electrolyzer to power a McFilling 350 refueling station able to distribute up to 800 kg per day of hydrogen at 350 bar at full capacity. The station will offer two Hi-Flow terminals with the ability to fuel all 7 buses in one hour.

The station will also offer a third terminal adapted to the filling of mobile storage units (tube trailers). This filling module could enable the use of low-carbon hydrogen to supply industrial uses remotely from the production site. The station is modular and configured to evolve with the growth of a project expected to go beyond this first stage.

A pioneering project that is expected to grow

The McPhy-equipped station is scalable and designed to support the growth of the Optymo network’s hydrogen bus fleet, which could be expanded to 20 additional buses by 2025, in addition to the seven initially planned. The station will also be able to supply all other forms of mobility at 350 bar, such as utility vehicles, garbage trucks or heavy goods vehicles circulating in the area. To this end, the site will be located in the immediate vicinity of the bus depot and at the crossroads of a highway linking France and Germany, perfectly meeting the needs of a local hydrogen ecosystem while contributing to the structuring of a hydrogen territorial grid in the region.

Next financial events

• 2021 Full-Year Sales, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy selected to equip a 100 MW electrolysis platform in Portugal

• The GreenH2Atlantic project consists in a 100 MW flexible green hydrogen production to be installed in Sines, Portugal, to supply multiple end-uses

• The consortium is composed of 13 European companies from the full value chain and of research partners, to which McPhy will bring the electrolysis technological brick

• The demonstrator will reduce greenhouse gas emissions by up to 80 kt CO2 equivalent per year

La Motte-Fanjas, December 21, 2021 – 06:00 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announces that it has been selected as preferred supplier to equip, in Sines, Portugal, the GreenH2Atlantic project with a 100 MW electrolysis plant. Heads of terms have been negotiated and supply agreement expected to be finalized during the first semester 2022. The project aims to demonstrate the viability of green hydrogen on a scale of unprecedented production and technological application.

Renewable hydrogen production in Sines advances with the GreenH2Atlantic project

Under the name GreenH2Atlantic, the renewable hydrogen production project in Sines will be developed by a consortium composed of 13 entities, including companies such as EDP, Galp, ENGIE, Bondalti, Martifer, Vestas Wind Systems A/S, McPhy and Efacec, and academic and research partners such as ISQ, INESC-TEC, DLR and CEA, in addition to a public-private cluster, Axelera.

GreenH2Atlantic was one of the three projects selected by the Horizon 2020 – Green Deal Call to demonstrate the viability of green hydrogen production on an unprecedented scale. The 30 million euros grant will help to finance the construction of the hydrogen plant, located in the coal-fired power plant area in Sines. The construction should start in 2023 and operation is expected to begin in 2025, subject to securing the necessary authorizations by the authorities.

A 100 MW electrolysis platform designed and manufactured by McPhy

McPhy has been selected as preferred partner, with its innovative electrolysis technology “Augmented McLyzer” which will convert green electricity by electrolysis into more than 41 tons of clean hydrogen per day. This 100 MW electrolyzer will be composed of innovative, scalable and fast-cycling 8 MW modules designed, manufactured and integrated by McPhy. The electrolysis platform is to supply green hydrogen for industrial (refinery) and energy (injection in the gas grid) uses, upscaling the link between renewables and industry, mobility and energy applications.

Green hydrogen is expected to become one of the pillars of economic growth, for it is a decisive energy vector in the decarbonization process for the main sectors of the economy. This project will enable the transition of a former coal-fired power plant into an innovative renewable hydrogen production hub, in alignment with Europe’s decarbonization and energy transition strategies.

With the creation of a ‘hydrogen valley’ centered in Sines, GreenH2Atlantic will significantly contribute to the sustainability goals of the region and Portugal and will provide an important contribution to the European energy roadmap.

Note: The project GreenH2Atlantic has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement nº 101036908.

Erratum: In the press release dated 12/21/2021, “McPhy selected to equip a 100 MW electrolysis platform in Portugal”, it should have been read “its innovative electrolysis technology “Augmented McLyzer” which will convert green electricity by electrolysis into more than 41 tons of clean hydrogen per day” and not per year as mistakenly stated. Below are the corrected press releases.

Next financial events

• 2021 Full-Year Sales, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

Information on McPhy’s remuneration policy, retention program and governance evolution

• Review of the remuneration philosophy at Group level

• Retention plan in performance shares for employees

• Remuneration of the new Chief Executive Officer

• Support for the Chief Executive Officer on taking up his position

• LTI (Long Term Incentive) 2021 plan in performance shares for new executives

• Governance evolution; change of Chart’s permanent representative on the Board of Directors

La Motte-Fanjas, December 17, 2021 – 07:30 am CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announces that the Board of Directors, held on December 16 2021, adopted a number of decisions relating to the remuneration policy for employees and its new Chief Executive Officer, the support for the Chief Executive Officer in taking up his new position and the retention program, and noted the change in the permanent representative of the Chart company, one of its shareholders, on the Board of Directors.

Remuneration policy at Group level

As part of the deployment of its strategic plan, the McPhy Group, through its General Management and Board of Directors, has initiated during the 2021 fiscal year a reflection on its remuneration philosophy and guiding principles in order to implement one of the pillars of its strategy: “Invest in Our People”.

This strategic pillar, a key success factor in McPhy’s growth plan, consists in the retention and development of the Group’s talents and in strengthening the attractiveness of the company for its existing and future employees.

A remuneration competitiveness study allowed the building of a strong roadmap for the transformation of the remuneration policy to support the company’s medium/long-term growth objectives. The short-term actions identified have either been implemented in 2021 or will be continued in 2022 and are as follows:

- the specific measures related to employee remuneration increases,

- the implementation of an exceptional retention plan in performance shares for all McPhy employees,

- the implementation of a long-term incentive plan for the Group’s new executives,

- remuneration schemes linked to collective performance and the development of employee shareholding, which will be the subject of negotiations with the social partners and will be set out in more detail in the 2022 Universal Registration Document.

Implementation of an employee retention plan in performance shares

In order to recognize and associate employees with the company’s success, the Board of Directors, on the recommendation of the Appointments and Remuneration Committee, decided on December 16, 2021 an exceptional democratic allocation of 30,220 free shares to all McPhy employees (23rd resolution of the Shareholder General Meeting of May 23, 2019).

These shares are subject to a vesting period of more than 2 years, with vesting on the date of the Board meeting held to approve the accounts for the year ending December 31, 2023, and to performance conditions in line with the company’s mission and medium-term objectives. The performance conditions are focused on operational performance criteria (70%) and customer satisfaction (30%).

This plan constitutes an exceptional grant. From 2022 onwards, the General Management wishes to implement profit-sharing agreements that will be negotiated with the social partners, involving employees in the company’s performance and strengthening employee shareholding.

The Chief Executive Officer is not a beneficiary of this grant.

Remuneration of the new Chief Executive Officer of McPhy

Following the appointment of Mr. Jean-Baptiste Lucas as Chief Executive Officer on October 18, 2021, the Board of Directors of McPhy, on the proposal of the Appointments and Remuneration Committee, set the remuneration of the new Chief Executive Officer in accordance with the remuneration policy approved by the Shareholder General Meeting on June 17, 2021 (10th resolution).

In view of McPhy’s context, its size and its challenges, the Appointments and Remuneration Committee mandated in April 2021 a specialized consultancy firm to assist it in carrying out a study on the remuneration of its executives on a panel of companies similar to McPhy corresponding to its recruitment markets.

• Annual fixed remuneration

Based on the results of this study, the Board of Directors set the annual fixed remuneration of the Chief Executive Officer at a gross annual amount of €240,000.

• Annual variable remuneration

In accordance with the remuneration policy for executive directors approved by the Shareholder General Meeting of June 17, 2021, the target annual variable remuneration of the Chief Executive Officer is set at 50% of the annual fixed remuneration if all the performance objectives set by the Board of Directors are met, with no minimum amount guaranteed, and may reach 130% of this amount if the objectives are exceeded.

In view of the date on which the Chief Executive Officer took up his position, the Board of Directors chose to modify the remuneration criteria applicable to the previous Chief Executive Officer around very operational objectives for his period of presence during the 2021 financial year with 4 performance criteria in line with the Group’s strategic challenges:

- 1 financial criteria of revenue on the basis of the 2021 reforecast (representing 25% of the variable remuneration and whose 70% trigger threshold is subject to the achievement of 95% of the objective).

- 2 strategic operational criteria to be implemented in the short term (representing 50% of the variable remuneration and whose trigger thresholds are 100% of the achievement of the objectives).

- 1 quantitative objective related to Human Resources (representing 25% of the variable remuneration and whose triggering threshold is 100% of the achievement of the objectives).

• Exceptional remuneration in free shares (taking up of mandate)

The new Chief Executive Officer, due to the acceptance of his appointment within McPhy, has agreed to a reduction in his remuneration compared to his former position.

In accordance with the remuneration policy for executive directors approved by the Shareholder General Meeting of June 17, 2021, the Board of Directors of October 11, 2021 approved the principle of compensating the Chief Executive Officer for this wage reduction with a comparable level of risk in the form of an exceptional grant of 20,000 free McPhy shares.

Under the terms of the 23rd resolution of the Shareholder General Meeting of May 23, 2019, the Board of Directors of December 16, 2021, on the recommendation of the Appointments and Remuneration Committee, granted 20,000 free shares to the Chief Executive Officer.

The value of the shares at the date of the agreement corresponds to the value of the benefits waived by the Chief Executive Officer, i.e. €340,000 gross, calculated on the basis of a stock market price of €17, which is the average of the previous 20 prices on October 11, 2021. The shares granted are subject to a 2-year presence condition.

• Remuneration in shares or other financial instruments

Future grants of free shares to the new Chief Executive Officer will be subject to performance conditions in line with the Group’s objectives and medium-term vesting conditions in line with market practice and investor expectations. The principles and mechanisms of the proposed LTI 2022 plan will be described in the 2021 Universal Registration Document.

• Other remuneration elements

The Chief Executive Officer does not benefit from any supplementary pension scheme.

In the event of departure, the Chief Executive Officer is subject to an 18-month non-compete obligation under the conditions defined in the 2020 Universal Registration Document.

The Board of Directors, on the recommendation of the Appointments and Remuneration Committee, also approved the principle of paying a severance payment of up to two times his last annual fixed remuneration, in case of dismissal at the initiative of the Board of Directors and subject to the achievement of performance conditions set by the Board. However, this indemnity will not be paid in the event of dismissal for gross misconduct.

The total of the severance allowance and the non-competition allowances mentioned may not exceed two years of annual remuneration (fixed + annual variable remuneration excluding LTI).

The Chief Executive Officer benefits from a company car, a social protection scheme, the social guarantee for company directors and managers (GSC) and civil liability insurance for corporate officers.

Accompanying the Chief Executive Officer in taking up his new position

In order to best assist the Chief Executive Officer in taking up his new position, the Board of Directors of the company, during its meeting of October 11, 2021, authorized the conclusion of an assistance agreement signed on October 18, 2021 between McPhy Energy SA and Mr. Luc Poyer (via his company France Energies Nouvelles), Director and Chairman of the Board of Directors, in the context of the managerial transition with the new Chief Executive Officer.

Details of this agreement are provided on the company’s website Regulated agreements & Commitments | McPhy.

Implementation of a 2021 LTI (Long Term Incentive) plan in performance shares for new executives

The Board of Directors, on the recommendation of the Appointments and Remuneration Committee, decided on December 16, 2021, to grant 9,750 free shares (23rd resolution of the General Meeting of May 23, 2019) to new McPhy executives who joined the Executive Committee since September 1, 2020. These shares are subject to a vesting period of plus 2 years, with vesting on the date of the Board meeting held to approve the financial statements for the year ended December 31, 2023 and subject to the satisfaction of performance conditions in line with the company’s mission and medium-term objectives. The performance conditions are focused on operational performance criteria (50%), customer satisfaction (30%) and onsocial and environmental responsibility (20%).

The Chief Executive Officer is not a beneficiary of this grant.

Change of Chart’s permanent representative on the Board of Directors

In addition to its decisions regarding the employee remuneration policy and the retention program, the Board of Directors, at its meeting of December 16, 2021, took note of the appointment of Mr. Petr Gerstl, Director of Hydrogen Sales for EMEA, as a permanent representative of Chart Industries, Inc., in replacement of Mrs Jillian C. Evanko (Harris).

Next financial events

• 2021 Full-Year Sales, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy signs a strategic partnership with Hype to structure the hydrogen mobility sector

A strategic agreement with several dimensions:

- The commercial part consists in the securing of firm short-term orders in 2022 and in a privileged access to a potential market of about 50 high-capacity hydrogen stations and 15 to 25 megawatts of electrolysis by 2025;

- The technological part of the agreement will focus on the mutualization of expertise, with a view to standardizing equipment, improving technical performance and increasing their economic competitiveness;

- The financial dimension of the partnership will materialize by an investment of 12 million euros by McPhy in the form of convertible bonds to be issued by Hype.

La Motte-Fanjas, December 14, 2021 – 06:00 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), (the “Company”), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), announces that it has signed a strategic partnership agreement with Hype, a group at the forefront of hydrogen infrastructure deployment for zero-emission urban mobility solutions in France and Europe.

As a key player in the structuring of light and heavy hydrogen mobility, Hype is relying on a first market that is immediately relevant for hydrogen – the urban cab – in order to deploy a hydrogen production and distribution network opened to all other forms of urban mobility: utility vehicles, buses, trucks, etc. Directly operating the world’s largest fleet of hydrogen cabs, which is expected to exceed 700 vehicles during 2022, Hype’s ambition is to deploy 10,000 zero-emission cabs and 20 high-capacity stations in the Paris region by the end of the 2024 Olympic Games, and to expand to 15 other cities around the world, in target areas such as Spain, Portugal, Italy, Belgium and the United Kingdom by the end of 2024. This growth plan should represent a total of around 40,000 vehicles and about 100 stations by the end of 2025 and is supported by major shareholders, including the Banque des Territoires (CDC).

The strategic agreement between McPhy and Hype is part of this development plan, and includes commercial, technological and financial aspects.

Jean-Baptiste Lucas, Chief Executive Officer of McPhy, stated: “The agreement signed with Hype is part of an ambitious strategic approach to actively contribute to the integration of the hydrogen industry in France. The combination of Hype’s offer, as an operator of hydrogen vehicles and infrastructures, and McPhy’s one, as a supplier of hydrogen production and distribution solutions for zero-emission mobility, provides an example of the cooperation needed to synchronize the mass production of hydrogen vehicles and the infrastructures required for their use.”

“We are delighted with this strategic alliance with McPhy, which perfectly illustrates the ambitions of the Hype project. With McPhy, we have found a partner who, like us, is putting all its know-how at the service of the fast and ambitious deployment of a French hydrogen industrial sector”, said Mathieu Gardies, President of Hype.

New orders for high-capacity stations and electrolyzers for McPhy

The cooperation between the two groups will materialize in 2022 with firm orders for the supply to Hype of a 2 to 4 MW alkaline electrolyzer and a 800 kg / day hydrogen station.

These first orders could be followed, subject to confirmation of specific subsidies requested by Hype in 2021, by additional orders in 2023, for a new multi-megawatt electrolyzer and 5 additional high-capacity hydrogen stations.

With a potential of orders of 50 stations and 15 to 25 megawatts by end of 2025, this cooperation opens many opportunities in the medium term

These first orders could be followed by other commercial opportunities, as part of the establishment by the end of 2022 of a co-exclusive framework agreement between Hype and McPhy. This agreement covers the deployment by Hype of a minimum of 100 stations in France and Europe, of which 50% would be allocated to McPhy.

As part of this agreement, McPhy would also be designated as the preferred partner

For the supply of 15 to 25 MW of alkaline electrolysis.

A similar co-exclusivity agreement, on a parity basis for the supply of high-capacity hydrogen refueling stations, has also been reached between Hype and the HRS company.

A strong technological component, in a logic of joint innovation

In addition to their commercial collaboration, McPhy will have access to the data collected by Hype vehicles, in order to optimize its offer of stations and electrolyzers. This technological partnership is based on the mutualization of expertise, with a view to standardizing equipment, improving technical performance and increasing their economic competitiveness.

12-million-euro investment in the form of convertible bonds

In order to strengthen its cooperation, McPhy will subscribe at the date of formalization of the firm order mentioned above, an amount of €12 million in Hype’s convertible bonds which will bear interest at 4.5% per year and redeemable after 9 years from their subscription. These bonds may be converted into Hype shares, prior to their maturity date, under certain conditions and in limited circumstances, including a change of control, an initial public offering or a share issuance in excess of €10 million.

Through this transaction, McPhy is entering into a partnership with a leading operator in zero-emission urban mobility, based on a common vision of the democratization of green hydrogen for the decarbonization of the transportation sector. The integration of McPhy equipment into Hype’s “turnkey” mobility offer, which synchronizes the large-scale supply of hydrogen vehicles and their refueling infrastructure, will give the Group access to a portfolio of opportunities that should represent a very significant business volume in the coming years, and already secures orders for the coming years. The stations planned under this partnership will be produced in McPhy’s new hydrogen station production facility, which will be operational in Grenoble in 2022.

Next financial events

• 2021 Full-Year Sales, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy signs a cooperation agreement with Enel Green Power for a major electrolysis project in Italy

• Signature of a Memorandum of Understanding with Enel, the leading Italian energy company

• McPhy preferred partner for the supply of an electrolyzer with a capacity of 4 MW for the Carlentini project

• A success for the new generation range of large electrolyzers Augmented McLyzer

La Motte-Fanjas, November, 30, 2021 – 5.45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY, FR0011742329), specialized in zero-carbon hydrogen production and distribution equipment (electrolyzers and refueling stations), today announces that it has signed a Memorandum of Understanding with Enel Green Power for the supply of a 4 MW pressurized alkaline electrolyzer from the Augmented McLyzer range that would be connected to a renewable energy park in Carlentini, Sicily. The aim of this installation would be to supply green hydrogen for a power-to-gas system and for hard-to-abate sectors.

This pioneering project is a perfect illustration of how renewable energies and hydrogen can combine to form the zero-carbon energy mix of tomorrow. Combining McPhy’s core expertise of high-pressure alkaline electrolysis with high current density electrodes, the Augmented McLyzer range was selected for its high flexibility and fast dynamic response, most suited to the intermittency of renewable energy and for the power market led operation.

Next financial event

• 2021 Full-Year Revenue, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu

McPhy announces the initiation of coverage of its stock by Liberum

La Motte-Fanjas, November 24, 2021 – 5:45 pm CET – McPhy (Euronext Paris, C Compartment: MCPHY, FR0011742329), a specialist in zero-carbon hydrogen production and distribution equipment (electrolyzers and recharging stations), is pleased to announce the initiation of coverage of its stock by Liberum with a study entitled “Blue sky models suggest upside”.

The McPhy stock is also covered by the brokerage firms:

- Barclays;

- Berenberg;

- Bryan Garnier;

- Gilbert Dupont / Groupe Société Générale;

- Jefferies;

- Kepler Cheuvreux;

- ODDO-BHF;

- Panmure Gordon; and

- Portzamparc / Groupe BNP Paribas.

Upcoming of financial communication events:

• 2021 Full-Year Revenue, on January 25, 2022 (after market)

About McPhy

In the framework of the energy transition, and as a leading supplier of hydrogen production and distribution equipment, McPhy contributes to the deployment of zero-carbon hydrogen throughout the world.

Thanks to its wide range of products and services dedicated to the industrial, mobility and energy markets, McPhy provides turnkey solutions to its clients adapted to their applications in industrial raw material supply, fuel cell electric car refueling or renewable energy surplus storage and valorization.

As a designer, manufacturer and integrator of hydrogen equipment since 2008, McPhy has three development, engineering and production units based in Europe (France, Italy, Germany).

The company’s international subsidiaries ensure a global sales coverage of McPhy’s innovative hydrogen solutions.

McPhy is listed on NYSE Euronext Paris (Segment C, ISIN code: FR0011742329; ticker: MCPHY).

Media relations

NewCap

Nicolas Merigeau

T. +33 (0)1 44 71 94 98

mcphy@newcap.eu

Investor relations

NewCap

Emmanuel Huynh

T. +33 (0)1 44 71 94 99

mcphy@newcap.eu